Homebuying is effectively impossible.

That’s according to data from PYMNTS’ February “Consumer Inflation Sentiment Report,” which is backed up by the February S&P CoreLogic Case-Shiller Home Price Indices released last week.

Just in time for the traditional selling season, the market experienced only a small 0.2% uptick compared to the more significant 3.7% rise the previous month, the indices found. Impacted by rising mortgage rates, home prices may be moderating as the national average slips 4.9% below its June 2022 heights, with some West Coast cities seeing negative year-over-year sales growth.

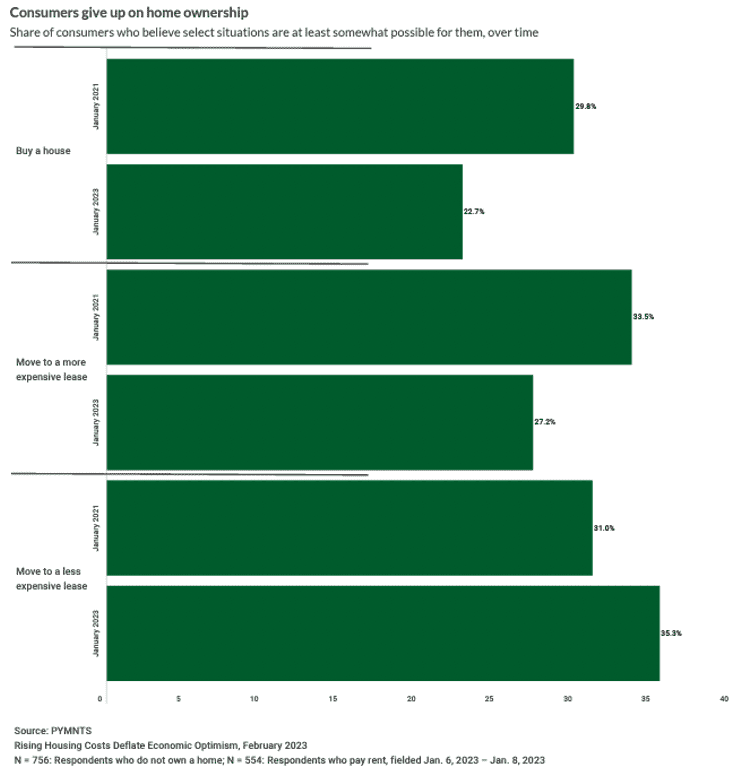

The modest house price decline may be welcome news to potential buyers who have so far given up on their homeownership dream. However, purchasing plans may still be out of reach when combining prices with currently high mortgage rates against wages not quite keeping pace with inflation, confirming consumer belief. As detailed in the PYMNTS report, the share of consumers finding homebuying at least somewhat possible for them dropped from 30% in January 2021 to 23% in January 2023.

It may be little wonder that a large share of consumers has scuttled their homebuying plans. Inflation’s loosening grip has yet to significantly bring down the cost of essential goods, where consumers spend an average 22% of their income. While the dwindling numbers of consumers believing homeownership is out of their reach are significant, they may also be realistic.

Mortgage rates are expected to remain at elevated levels through the coming months, as reflected in recent Federal Reserve staff notes, impacting monthly payments for all but cash-only homebuyers.

Not all consumers can or want to wait until market conditions are perfect to realize their homebuying goals, however. Despite the current shaky housing market, there are some solid tools to help potential buyers. In October, real estate company Redfin added a button to its home listing pages offering information about programs related to down payment assistance and affordable lending. Created in partnership with Down Payment Resource, the feature aims to connect potential purchasers with 2,200 homebuyer assistance programs.

More recently, SoFi announced its acquisition of Wyndham Capital Mortgage to bolster its digital mortgage offerings meant for potential homeowners. The all-cash purchase allows SoFi to reduce consumer-facing friction by decreasing its use of third-party partners and processes.

It may be worth noting that there are some bad players in the mortgage space as well. The Consumer Financial Protection Bureau (CFPB) shared findings last month of “unlawful junk fees” in multiple industries, including mortgage servicing. In a separate investigation, the CFPB permanently banned Majestic Home Loans, a California mortgage broker, from the industry. Preying on military families, Majestic disseminated millions of mortgage advertisements implying it was affiliated with the Department of Veterans Affairs and the Federal Housing Administration by illegally using their logos to deceive consumers.

With the near-certainty of mortgage rates staying high for the foreseeable future, consumers considering a home purchase may do best waiting a while longer. Should housing prices adjust, the homeownership dream may then become a reality for these consumers.