FinTech Partnerships Surge as Insurance Firms Adopt Real-Time Disbursements

Insurance firms are increasingly embracing real-time payments for business-to-business (B2B) transactions, viewing them as essential to success. More than two-thirds plan to increase the use of real-time payments for inbound transactions, citing speed as the driving factor.

Insurance firms are increasingly embracing real-time payments for business-to-business (B2B) transactions, viewing them as essential to success. More than two-thirds plan to increase the use of real-time payments for inbound transactions, citing speed as the driving factor.

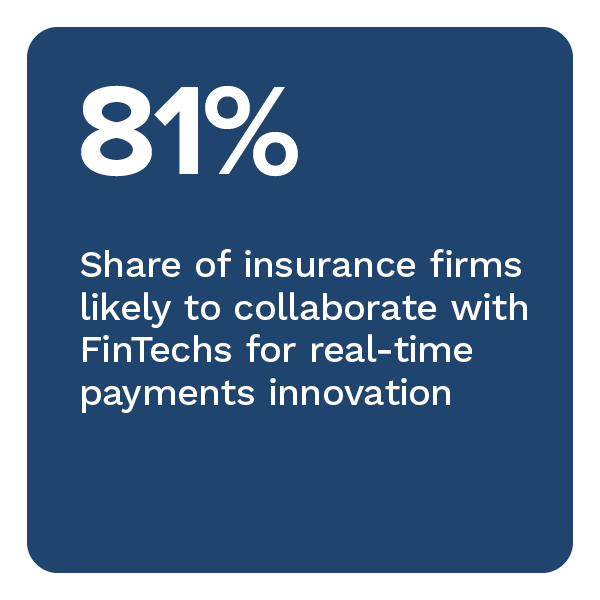

PYMNTS’ latest research shows that insurance firms are recalibrating payments strategies as real-time payments race ahead. Eighty-one percent of firms are considering partnering with FinTechs to innovate and enhance their real-time payments offerings.

These are just some of the findings detailed in “Corporate Changes in Payment Practices: A Deep Dive Into the Insurance Industry,” a collaboration with The Clearing House. This report examines the surge in real-time payments adoption for B2B transactions among insurance firms and the factors driving this change. The report draws on insights from a survey of 125 insurance executives with deep knowledge of the payments environment, conducted from April 5 to May 5.

Key findings from the report include the following:

Real-time payments dominate insurance B2B transactions.

Real-time payments dominate insurance B2B transactions.

The insurance industry is increasingly adopting real-time payments for B2B transactions. Currently, 80% of firms make real-time B2B payments, and 84% are receive these payments. Large firms generating more than $1 billion in annual revenue are the most likely to have already implemented real-time payments to make and receive payments.

Speed and ease of use drive adoption of this payment method.

Speed and ease of use are the primary reasons cited by insurance companies for adopting real-time payments. Firms planning to increase their use of real-time payments for inbound transactions cite speed as the top reason, at 68%. Moreover, 64% of companies that expect to use real-time payments more for making payments attributed the decision to ease of use and convenience.

FinTech collaboration is key in real-time payments innovation.

Insurance firms are looking to collaborate with FinTechs to enhance their real-time payments offerings. We found that 81% of insurance companies will likely partner with FinTechs for future real-time payments innovations. Additionally, 74% of insurance firms plan to introduce additional real-time B2B payments features in the next 12 months, pointing to a strong focus on innovation in their B2B payment practices.

Real-time payments have emerged as a top choice among insurance firms for making B2B transactions. Still, these firms must understand how quickly the state of play is changing and the importance of keeping up with innovations, as real-time payments are likely to become the leading form of payments. Download the report to learn more about how real-time payments are revolutionizing B2B relationships in the insurance industry.