NEW REPORT: Where Restaurants Should Look For New Loyalty Opportunities

The first wave of lockdowns in the United States put consumers’ lives – and their menus – on reset. Working professionals no longer had the option of going out on their lunch breaks, while parents suddenly found themselves having to cook for their families three times each day, at least. It is no wonder that overall takeout spend has surged.

The first wave of lockdowns in the United States put consumers’ lives – and their menus – on reset. Working professionals no longer had the option of going out on their lunch breaks, while parents suddenly found themselves having to cook for their families three times each day, at least. It is no wonder that overall takeout spend has surged.

Ordering takeout or delivery has become a central part of many  consumers’ lives in the past year, with single consumers, couples and parents alike reaching for their phones whenever they run out of groceries, dinner ideas or the energy they need to prepare their meals from scratch.

consumers’ lives in the past year, with single consumers, couples and parents alike reaching for their phones whenever they run out of groceries, dinner ideas or the energy they need to prepare their meals from scratch.

Many of these orders have been placed online. The average U.S. household has spent $10,832 on food orders since statewide shutdowns were declared in March 2020, with $4,520 — or 42 percent — of that spend being made online. Another $3,034 of that total consumer spend was made over the phone, and $3,278 was made in person, by contrast.

It is clear that digital food orders have become critical to restaurant businesses since the pandemic’s onset, but not all U.S. households order their food in the same manners or in the same quantities. Which types of U.S. households are spending the most on food orders, and what types of ordering features do they believe can enhance their food ordering experiences?

In the sixth edition of Delivering On Restaurant Rewards, a PYMNTS and  Paytronix collaboration, we take a close look at how different types of American households are using food orders to ease the stress of cooking for their families as the pandemic continues. We surveyed a census-balanced panel of 2,149 U.S. consumers to learn how much single consumers, married couples, single parent and married parents have spent on food orders in the past year, how much of that spending has been made online and how loyalty programs and digital ordering features drive their restaurant spend.

Paytronix collaboration, we take a close look at how different types of American households are using food orders to ease the stress of cooking for their families as the pandemic continues. We surveyed a census-balanced panel of 2,149 U.S. consumers to learn how much single consumers, married couples, single parent and married parents have spent on food orders in the past year, how much of that spending has been made online and how loyalty programs and digital ordering features drive their restaurant spend.

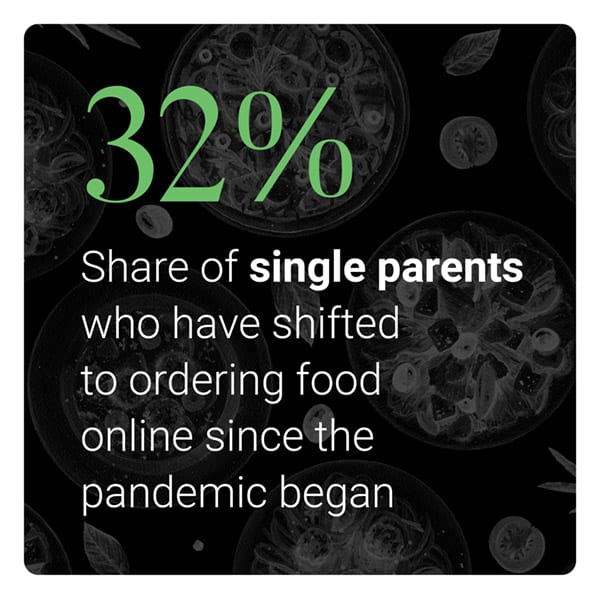

Our research shows that among the four types of U.S. households in our study, consumers with children are the most likely to have shifted to placing those food orders online. Thirty-two percent of all restaurant customers who are also single parents say they are ordering more online and less in-person now than they did before the pandemic began, while 25 percent of married parents have done the same. Only 18 percent of single consumers and 12 percent of married couples without children have made this digital leap, underscoring how parents have tapped the convenience of online ordering as a way to relieve their quarantine culinary woes.

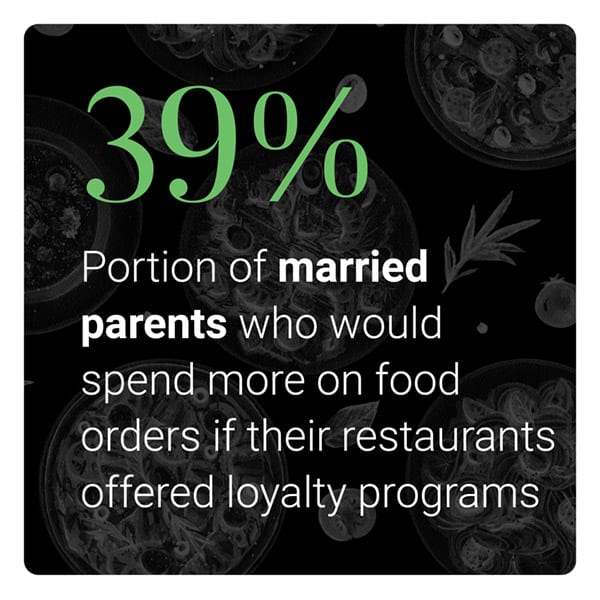

Parents are  also more likely than single consumers and married couples without children to be using restaurants’ loyalty and reward programs to get more value out of their frequent restaurant orders. Fifty-three percent of married parents who order from sit-down restaurants use loyalty programs, for example, as do 46 percent of single-parent, sit-down restaurant customers. Among single consumers and married couples without children, these figures are 26 percent and 29 percent, respectively.

also more likely than single consumers and married couples without children to be using restaurants’ loyalty and reward programs to get more value out of their frequent restaurant orders. Fifty-three percent of married parents who order from sit-down restaurants use loyalty programs, for example, as do 46 percent of single-parent, sit-down restaurant customers. Among single consumers and married couples without children, these figures are 26 percent and 29 percent, respectively.

With so much variety in how much U.S. households spend on food orders, the pressure is on for restaurants to adopt digital payment and loyalty and rewards features to help serve their diverse customers’ unique ordering and payment needs. The sixth edition of Delivering On Restaurant Rewards delves into which features they need to adopt to drive consumer restaurant spend.

To learn more about how these four types of U.S. households are using restaurant rewards to enhance their food ordering experiences, download the report.