23% of SMBs Want All-in-One Solution to Make Business Payments

Keeping payments flowing smoothly can be complex when making business-to-business (B2B) transactions.

One reason is that a mismatch exists between how payers and suppliers want to make and receive payments.

Half of small- to medium-sized businesses (SMBs) would prefer to receive payments either via real-time payment rails or same-day ACH, but payers’ most preferred methods are checks, credit cards or ACH, according to “The AP/AR Quick-Start Guide,” a PYMNTS and Plastiq collaboration.

Get the report: The AP/AR Quick-Start Guide

The key to satisfying both buyers and suppliers is payment choice: utilizing a platform or service that allows businesses to pay and receive funds using the terms that match their in-the-moment needs without disrupting payment experiences or inconveniencing the seller or receiver with long wait times.

An all-in-one payment solution allows transactions to happen seamlessly by prioritizing payment preferences for both sides of the transaction.

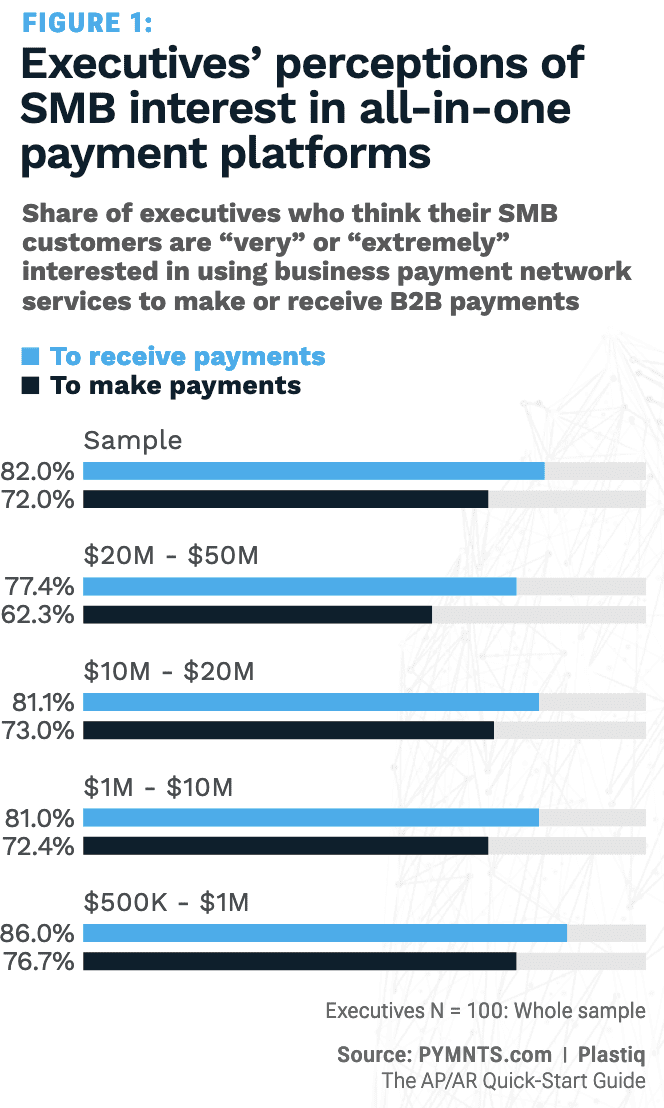

Eighty-two percent of executives think their SMB customers are very or extremely interested in using all-in-one payment platforms to receive B2B payments, and 72% say the same of using these platforms to make B2B payments.

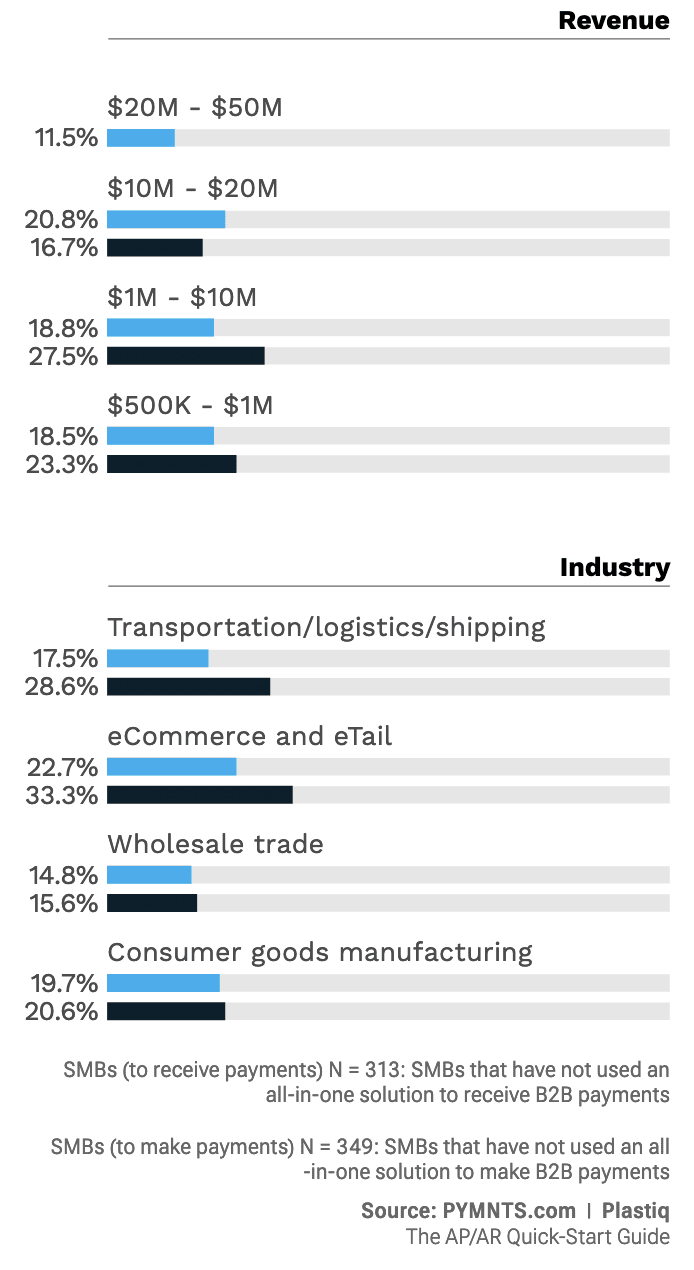

The shares of SMBs that do not use all-in-one payment solutions that are very or extremely interested in doing so are much smaller. Only 18% of SMBs are interested in using an all-in-one payment solution to receive payments, and just 23% are interested in using one to make payments.

This interest is strongest in the eCommerce and eTail industry, where 23% of SMBs would be interested in using an all-in-one payment solution to receive payments, and 33% would be interested in using one to make payments.

In addition, those in the transportation, logistics and shipping industry are more likely than average to be interested in using an all-in-one payment solution to make payments, while SMBs in the consumer goods manufacturing industry are more likely than average to be interested in using such a solution to receive payments.