eCommerce Fuels 2024 Optimism for Main Street Small Businesses

The COVID-19 pandemic accelerated the shift to an eCommerce economy, resulting in historically high sales in 2020 and 2021. Almost all small- to medium-sized businesses (SMBs) on Main Street see eCommerce as crucial for the sustainability and viability of their presence in the marketplace.

More than two-thirds of Main Street SMBs engage in online sales to expand customer reach and boost sales, demonstrating that eCommerce is essential for staying competitive with both larger companies and other SMBs. Nearly 70% have adapted to online sales to align with changing customer preferences. The businesses that serve Main Street SMBs should consider adapting their services to support this eCommerce shift.

These are just some of the findings detailed in “Main Street Health Survey Q4 2023: eCommerce Protects Main Street SMBs’ Bottom Line in a Cooling Market,” a PYMNTS Intelligence and Enigma collaboration. This edition draws insights from a survey of 540 SMBs that generate less than $10 million in annual revenue and have at least one brick-and-mortar location in commercial districts across the United States. It explores how eCommerce helps Main Street SMBs increase their business activity.

Other findings from the report include the following.

Virtually all Main Street SMBs recognize the importance of eCommerce for their business sustainability.

Nearly 8 in 10 Main Street SMBs use online channels, while an additional 16% are interested in implementing them. Moreover, the average Main Street SMB generates half its sales via online channels. Main Street retail SMBs lead the way, generating 54% of their sales from these channels.

High-revenue Main Street SMBs leverage more than one eCommerce platform to strengthen their online presences and expand their market reach.

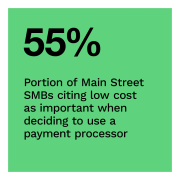

High-revenue Main Street SMBs demand more features from their eCommerce platforms than average Main Street SMBs, which are mostly interested in using the least expensive platforms. Ease of use was most important among high-revenue Main Street SMBs and those in the hospitality industry, such as hotels and restaurants. Professional service Main Street SMBs were particularly interested in the availability of data analytics tools provided by the platforms.

Main Street SMBs that rely heavily on eCommerce to drive sales maintain an optimistic outlook, despite reduced revenue expectations for 2023.

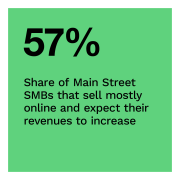

U.S. economic growth is projected to slow in Q4 2023 and Q1 2024, which helps explain why just 51% of Main Street SMBs expect their revenues to grow this year. However, the Main Street SMBs that use eCommerce channels remain optimistic. Fifty-seven percent of those that make most of their sales through eCommerce expect revenue to grow this year. Somewhat surprisingly, Main Street SMBs with similar sales across in-person and eCommerce channels are the most optimistic.

As the economy shows signs of slowing down, eCommerce will become an ever more important tool. Download the report to learn more about how Main Street SMBs use eCommerce to navigate a more challenging economic landscape.