Nearly Half of Main Street SMBs Shopping for More Credit

Main Street small to mid-sized businesses (SMBs) that have struggled to keep their doors open amid pandemic-related upheaval and survived are looking to solidify their finances amidst an inflationary market environment.

PYMNTS finds that 40% of SMBs remain more worried about inflation than one year ago. Fifteen percent report being concerned about declining revenues. That worry is not unfounded, especially for those with little or no access to readily available financing. Main Street SMB owners must be savvy about the different financing options available to them and carefully weigh the pros and cons of tapping into additional sources of credit.

PYMNTS finds that 40% of SMBs remain more worried about inflation than one year ago. Fifteen percent report being concerned about declining revenues. That worry is not unfounded, especially for those with little or no access to readily available financing. Main Street SMB owners must be savvy about the different financing options available to them and carefully weigh the pros and cons of tapping into additional sources of credit.

In “Main Street Health Q2 2023: Credit’s Key Role in SMBs’ Plans,” a PYMNTS and Enigma collaboration, we surveyed 514 SMB owners to understand which resources they plan to use to meet their businesses’ financial needs. This study unearths their evolving preferences when seeking new sources of funding beyond personal credit cards and highlights differences across different SMB segments such as construction, professional services, hospitality and retail.

Some key findings from the report include the following:

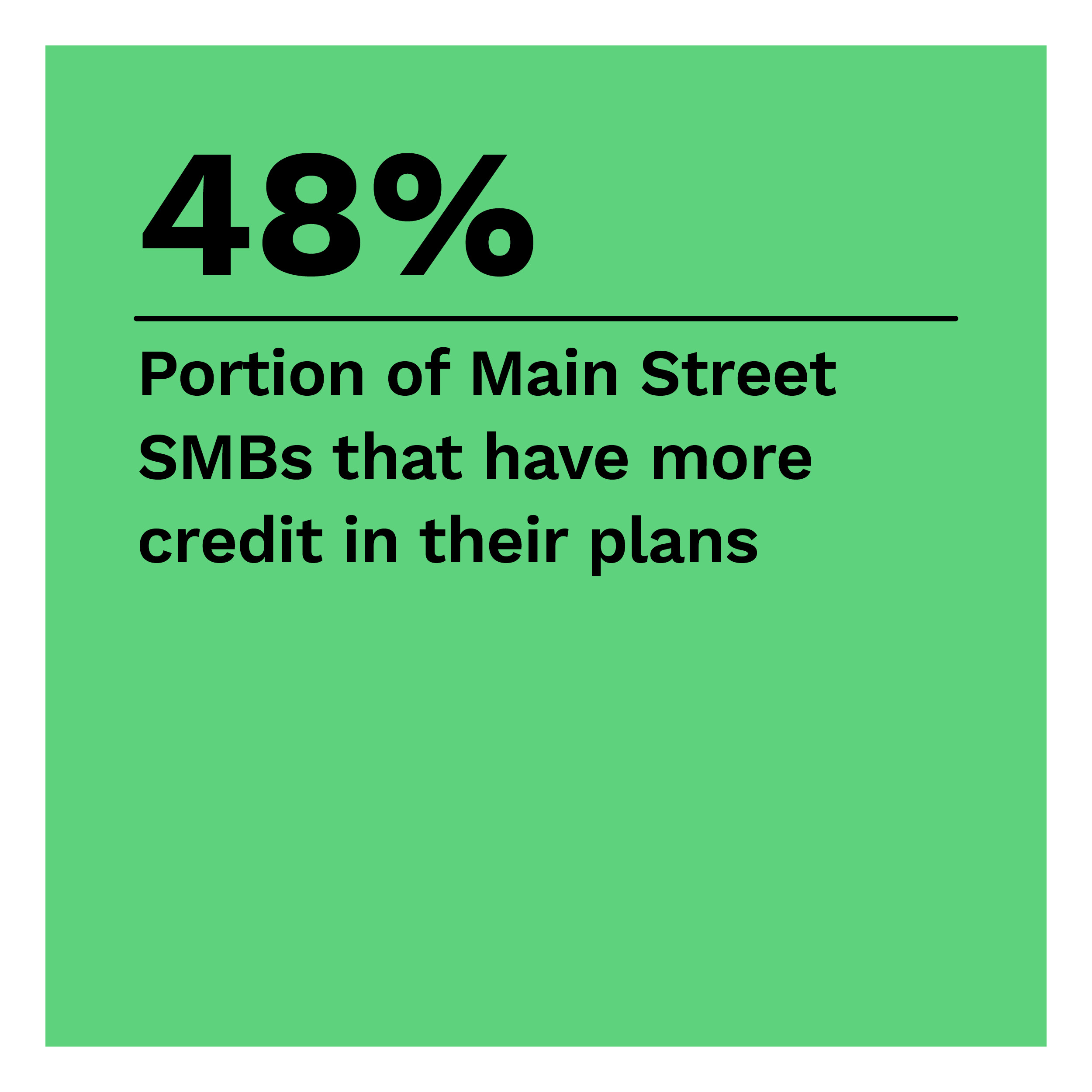

Nearly half of Main Street SMBs plan to increase the amount of credit they use or to start using credit.

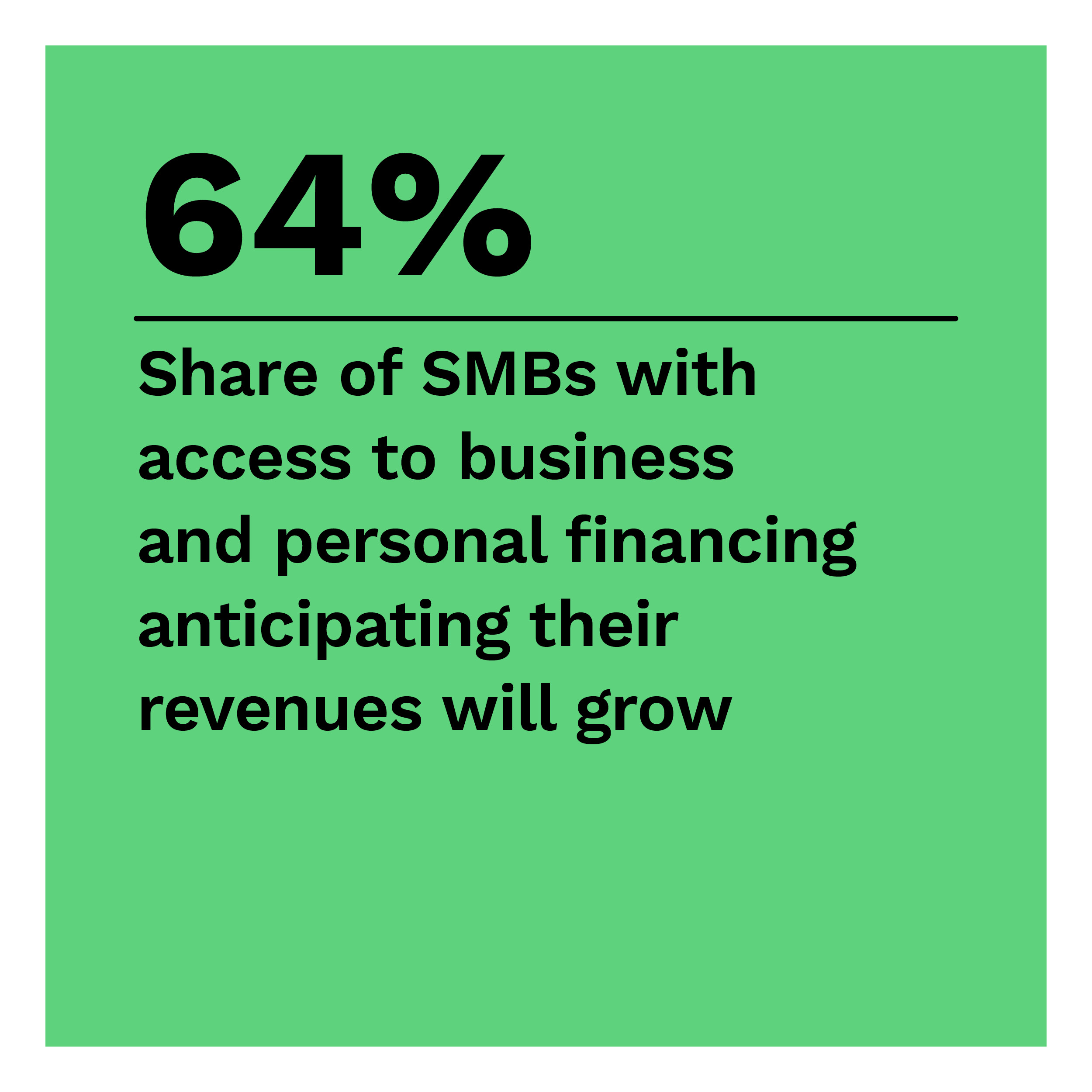

PYMNTS finds that 34% of all respondents do not currently use credit and want to begin doing so. Fourteen percent currently have access to business credit sources and want to expand their financing further. Main Street SMBs with more access to financing are more confident that their revenues will increase year over year.

Four in 10 Main Street SMBs will likely use business credit cards the most in the next 12 months.

Most Main Street SMBs are unaware of or unfamiliar with the range of financing options available. This may be because they are occupied with their day-to-day operations, did not qualify for or were denied other financing options. It may also be that lenders have not done enough to educate SMBs. These findings suggest that Main Street SMBs remain an underexplored market for financial lenders.

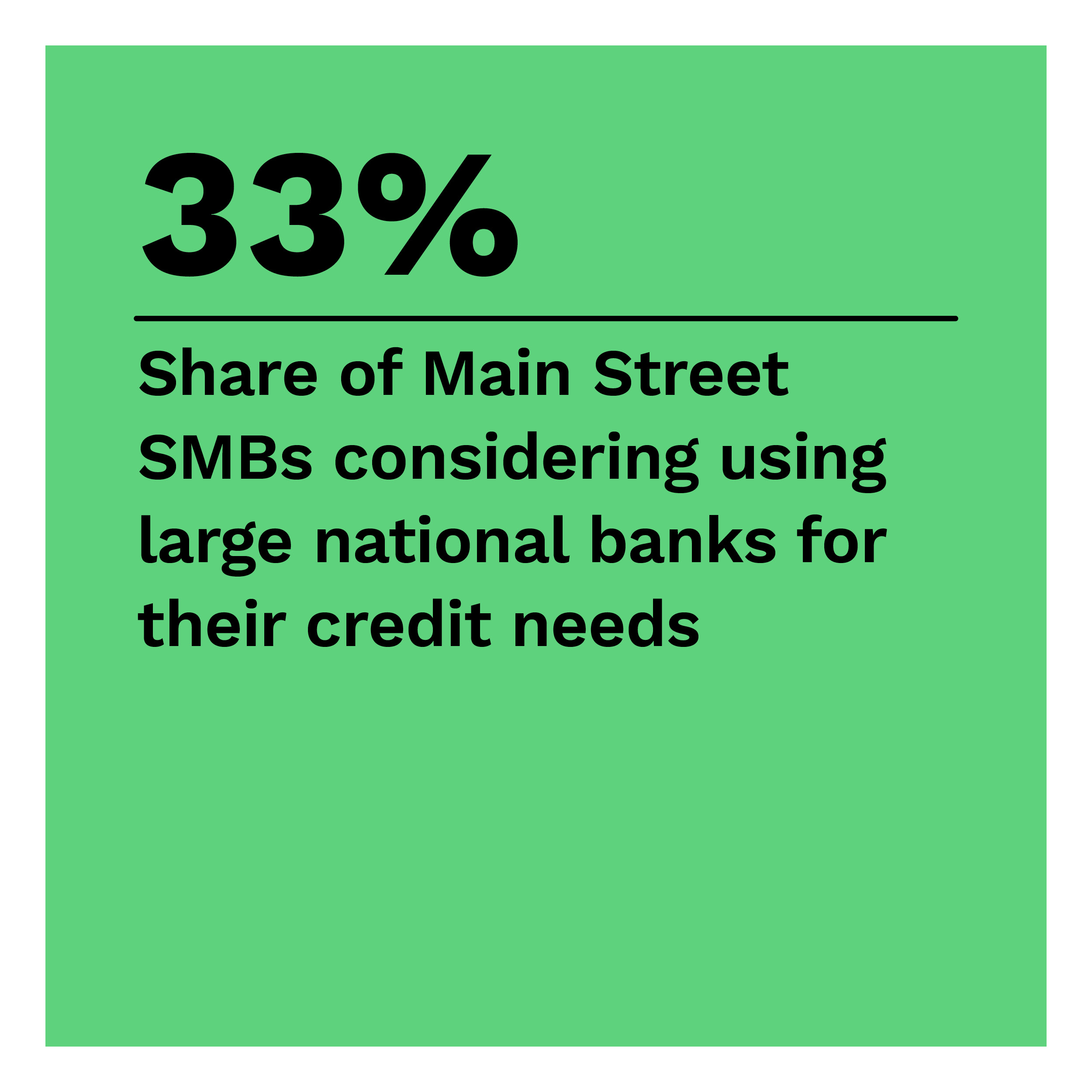

Large national banks are Main Street SMBs’ preferred financial institutions, though there are variations by type of industry.

One-third of Main Street SMBs will likely use large national banks to meet their financial needs — more than any other type of lender. Lenders will benefit from understanding SMBs’ preferences to identify the most suitable prospects. These preferences vary based on the SMBs’ relative size and line of business. For example, 39% of construction firms consider large banks for credit lines, while smaller firms are likelier to work with regional banks.

Financing and cash flow are essential to the viability of a business. Firms with greater access to cash and financing sources are less likely to be vulnerable to business closures and more likely to expect revenues to grow. Download the report to learn more about how SMB financing preferences are evolving.