76% of Main Street Businesses Would Run Out of Cash In 60 Days, Study Finds

Even as the economic outlook of small and medium-sized businesses (SMBs) has improved somewhat, 59% still believe we will go through a recession in the next year, and many are concerned that they don’t have the cash reserves to carry them through it.

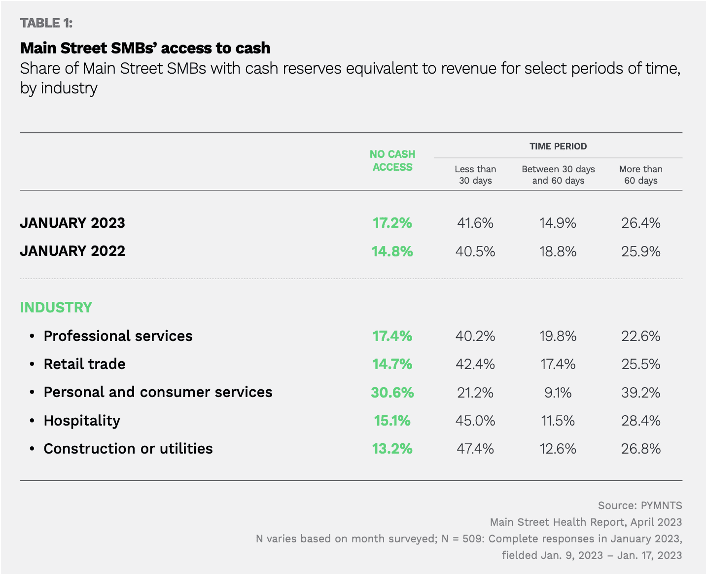

According to the study “Main Street Health Q1 2023,” a PYMNTS and Enigma collaboration based on a survey of over 500 SMBs with brick-and-mortar shops in commercial districts, only 26% of Main Street businesses have access to enough funding to stay open for more than 60 days in the event of a cash flow shortfall, and 17% have no access to funding at all.

The need for access to additional funding is clear from the new data, as 57% of Main Street SMBs say they have funding, “but only enough to operate for 60 days or fewer, underscoring a widespread need for new routes to funding their businesses in the near term.”

While it stands to reason that smaller SMBs are facing this dire situation — as 62% of SMBs with annual revenues of less than $150,000 do — the study states that “40% of Main Street SMBs generating between $1 million and $10 million in annual revenue have no readily available financing options that they might need to stay afloat if there were a sudden drop in sales.”

This indicates “a large and as yet unmet need for financing options to help defend against potential cash flow shortfalls.”

SMBs surveyed said that in the absence of a line of credit or another source of operating income, 40% said they can use business cards in case of a cash flow issue. “Meanwhile, the share of companies turning to business loans from online lenders, working capital loans from banks, and unsecured business loans are up 24%, on average, compared to last year.”

We found that 31% would use their personal credit cards to fill a cash flow gap, while 22% of Main Street SMB owners would “tap into their personal investment assets, and 18% would apply for a personal loan to stay open.”

Get your copy: Main Street Health Q1 2023