Liquidity Management and Forecasting Are Vital to Retailer and Manufacturer Processes

In the quest for better processes in procurement, accounts payable (AP), and accounts receivable (AR), liquidity is a cornerstone.

It’s the subject of “Payments Technology’s Future: Retailers, Manufacturers Seek Better Workflows,” a PYMNTS and Corcentric collaboration, based on a survey of 250 chief financial officers at retailers and manufacturers regarding their 2023 focus in these areas.

As retailers and manufacturers increasingly update their stacks using three years of pandemic and post-pandemic data to inform decisions, there are meaningful shifts in investment priorities based on cash flow, working capital and liquidity that is a boost to both.

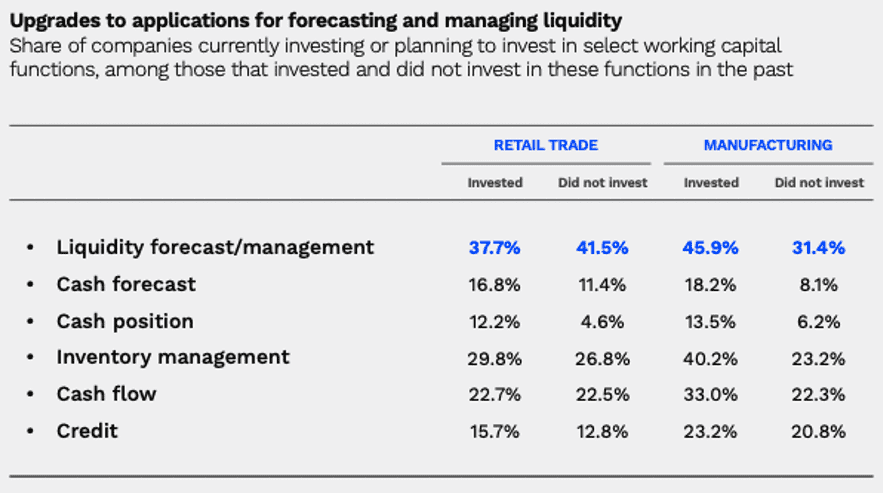

The survey found that 46% of manufacturers have already invested in their liquidity forecasting and management applications and continue to spend or intend to spend more improving these capabilities. For retailers, 38% of CFOs surveyed said they have previously spent on liquidity forecasting and management applications and plan to continue, while 42% of retailers that have not yet made these investments are doing so now or soon.

“Twenty-seven percent of manufacturers are investing in their AR systems, while 55% plan to invest in the future,” the study found. “Among retailers, 35% are investing in their AR systems, while 42% plan to make investments in the future. An increase is also projected for the systems for managing working capital and credit. Among manufacturers, 42% are investing in their working capital and credit systems, and 44% plan to make these investments. Thirty-one percent of retailers are investing in their working capital and credit systems, and 53% plan to make these investments.”

Retailers especially may be somewhat underinvested in digital liquidity management and forecasting capabilities, and many are now fast-tracking their spending on those systems.

PYMNTS found that 49% of retailers surveyed “are investing or planning to invest in their enterprise resource planning (ERP) applications, while 39% are making investments in their invoice approval applications. Manufacturers are also focused on investing in ERP applications for AP systems,” and 40% that have yet to invest in these applications have added it to their roadmap.