Virtual Cards Among Top 3 Working Capital Solutions

In today’s corporate landscape, as companies navigate the challenges of hybrid work arrangements and business travel, the demand for virtual cards has surged. These innovative payment solutions offer a range of benefits, from improved cash flow and simplified spending controls to data tracking and fraud protection.

Over the past decade, the use of corporate cards for commercial payments has traditionally been low, but as capital becomes more expensive and cards offer a flexible interchange fee model, firms are increasingly considering virtual cards as a solution for both planned and unplanned spending.

CFOs face new pressures in managing cash flow. By wisely selecting payment methods and leveraging virtual cards, companies can mitigate transaction fees and optimize their working capital.

The “2023-24 Growth Corporates Working Capital Index,” a collaboration between PYMNTS Intelligence and Visa, sheds light on the working capital needs of middle market companies (enterprises generating between $50 million and $1 billion in annual revenue), across various industry segments, global regions and countries.

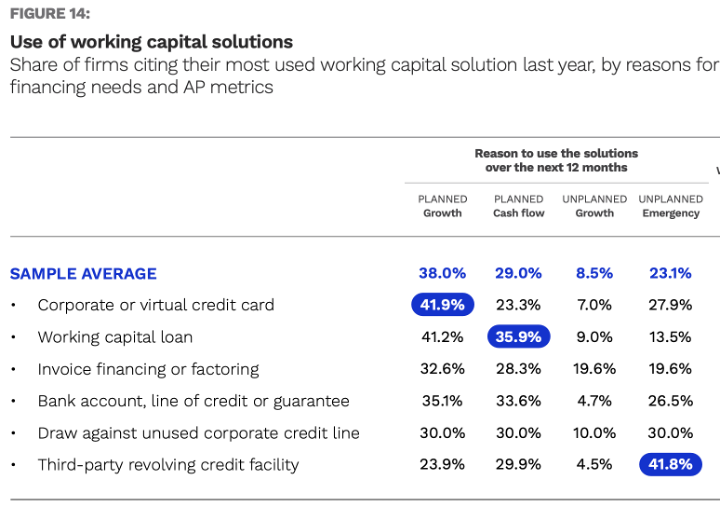

According to the study, corporate or virtual cards are the preferred option for planned growth use cases by 42% of CFOs, slightly above working capital loans. Surprisingly, the most efficient middle market companies — with operational efficiencies twice that of the overall sample — utilize virtual credit cards to support strategic business needs.

Thus, virtual cards have gained popularity among middle market CFOs for both planned and unplanned spending, with more than two-thirds considering them the most versatile working capital option.

As the corporate world continues to evolve, the adoption of virtual cards is set to accelerate. In addition to improving capital and reducing payment processing time, integrating mobile virtual cards into employee spending management systems can help companies regain control over expenses. Thus, growth prospects for further adoption of these cards are good. Although nearly half of the corporates that did not use virtual cards last year cited payment cost as the main barrier to using them, they expect to triple the use of these cards as a working capital solution for strategic and tactical spending. The benefits they offer make them an indispensable tool for modern businesses.

“In today’s operating environment, being reactive leaves firms at a disadvantage. Fortunately, virtual cards are changing the game for businesses by letting them proactively — and easily — control their spend,” Dan Hanks, vice president of global product development at i2c, said in an interview with PYMNTS.

The need for consumer-grade experiences, driven by hybrid work arrangements and business travel, has propelled the demand for these innovative payment solutions. Digitization has proven to be a key enabler, offering improved cash flow, reduced errors and simplified controls. Companies are now recognizing the importance of expanding corporate card programs and integrating mobile virtual cards to regain control over expenses and enhance employee experiences.