Subscription Businesses That Measure Lifetime Customer Value Outperform Competitors

PYMNTS’ latest research on the subscription industry reveals that firms that track and manage customer lifetime value (LTV) are five times more likely to be top performers at minimizing revenue loss due to failed payments.

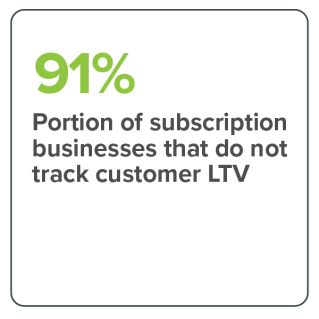

While most subscription firms track metrics such as customer churn and retention, just 8.5% measure LTV. Furthermore, just two in five subscription firms recognize the link between failed payments and LTV. However, those using LTV to guide their strategy recover 60% of the revenue they would otherwise lose to failed payments.

These are some of the key findings from “The State Of Subscription Business: Best Practices And Business Performance Drivers,” a collaboration with FlexPay. For this report, PYMNTS surveyed executives at 200 subscription-based companies to examine the connection between payment issues and customer churn, taking a deep dive into the best practices of the firms that effectively manage these challenges. Below are just a few of the findings:

• Ninety-one percent of subscription merchants do not measure customer LTV.

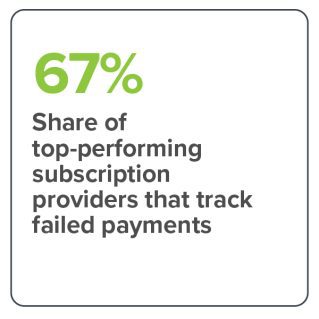

Despite its importance for profitability and growth, just 8.5% of subscription companies track LTV. Top performers in the industry track an average of three LTV-linked metrics, including failed payments, at 68%; customer churn rates, tracked by 40%; and LTV, tracked by 33%. In contrast, most subscription firms primarily track customer churn, at 36%, retention, at 28%, or both.

• Two in five merchants recognize failed payments as a strategic driver of customer value and business performance.

PYMNTS data reveals that 53% of subscription businesses track involuntary churn, and among those that do, just 20% identify it as the most important metric for improving business success. Furthermore, 44% of subscription providers believe that consumers place a high value on the payments experience, and just 15% track failed payments to improve customer LTV.

PYMNTS data reveals that 53% of subscription businesses track involuntary churn, and among those that do, just 20% identify it as the most important metric for improving business success. Furthermore, 44% of subscription providers believe that consumers place a high value on the payments experience, and just 15% track failed payments to improve customer LTV.

• Top-performing merchants are eight times more likely than bottom performers to track LTV and six times more likely to track failed payments.

These companies are 8.2 times more likely to measure LTV and six times more likely to measure failed payments than their bottom-performing counterparts, and they use this information to improve customer retention. On average, 30% of these firms track and analyze failed payments to improve customer LTV, while none of their bottom-performing counterparts did so.

To learn more about the best practices and performance drivers in the subscription industry, download the report.