High-Income Consumers Tap Pay-by-Bank Payments for Subscription Bills

Account-to-account (A2A) payments are catching on for subscriptions, especially among high-income consumers.

By the Numbers

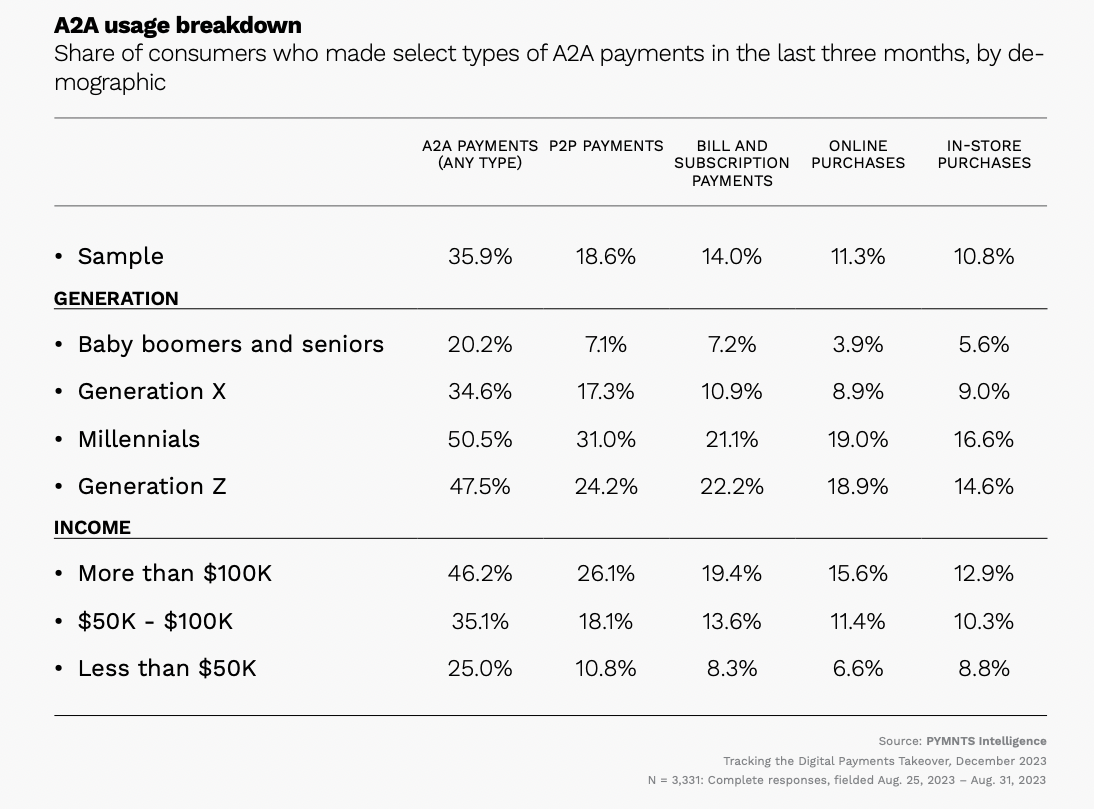

The report “Tracking the Digital Payments Takeover: Consumer Familiarity Controls Account-to-Account Payment Growth,” a PYMNTS Intelligence and AWS collaboration, drew from a survey of more than 3,300 U.S. consumers in August to understand consumers’ use of A2A payments.

According to the findings, A2A payments are gaining traction for a range of different occasions, with 14% of respondents using them to pay bills and subscriptions. Additionally, high-income consumers are likelier to adopt the payment method, with 19% of those who earn more than $100,000 per year doing so, versus 14% of those who earn $50,000 to $100,000 and 8% of those earning less than $50,000.

A Deeper Dive

The payment experience is key to subscriber loyalty. According to a PYMNTS Intelligence study last year, “Streamlining Bill Payment: How Frictionless Experiences Drive Customer Engagement,” which drew on responses from more than 2,900 U.S. consumers, 40% are interested in using service providers that offer an improved billing experience, and a substantial share of consumers would be willing to switch providers to obtain this.

Plus, better payment methods can solve for preventable issues. A study cited in the “Resolving Failed Payments for a Successful 2023” edition of PYMNTS and Vindicia’s Subscription Commerce Tracker® found that 70% of accidental payment cancellations are due to failed payment transactions — revenue loss that could have been avoided with improved payment methods.

In an interview with PYMNTS posted last year, Jesus Luzardo, vice president and head of global partnerships and international sales at Vindicia, noted that 8% to 10% of terminally failed payments are due to “issues in the payment infrastructure, from the merchant billing platform to payment processor to card network to issuing bank. All that infrastructure has inefficiency in communication between platforms.”