Pet Supply Stores Lose Sales Occasions to eCommerce Rivals

Traditional brick-and-mortar pet supply stores may want to watch their backs, as digitally native players keep consumers at home with subscription options.

By the Numbers

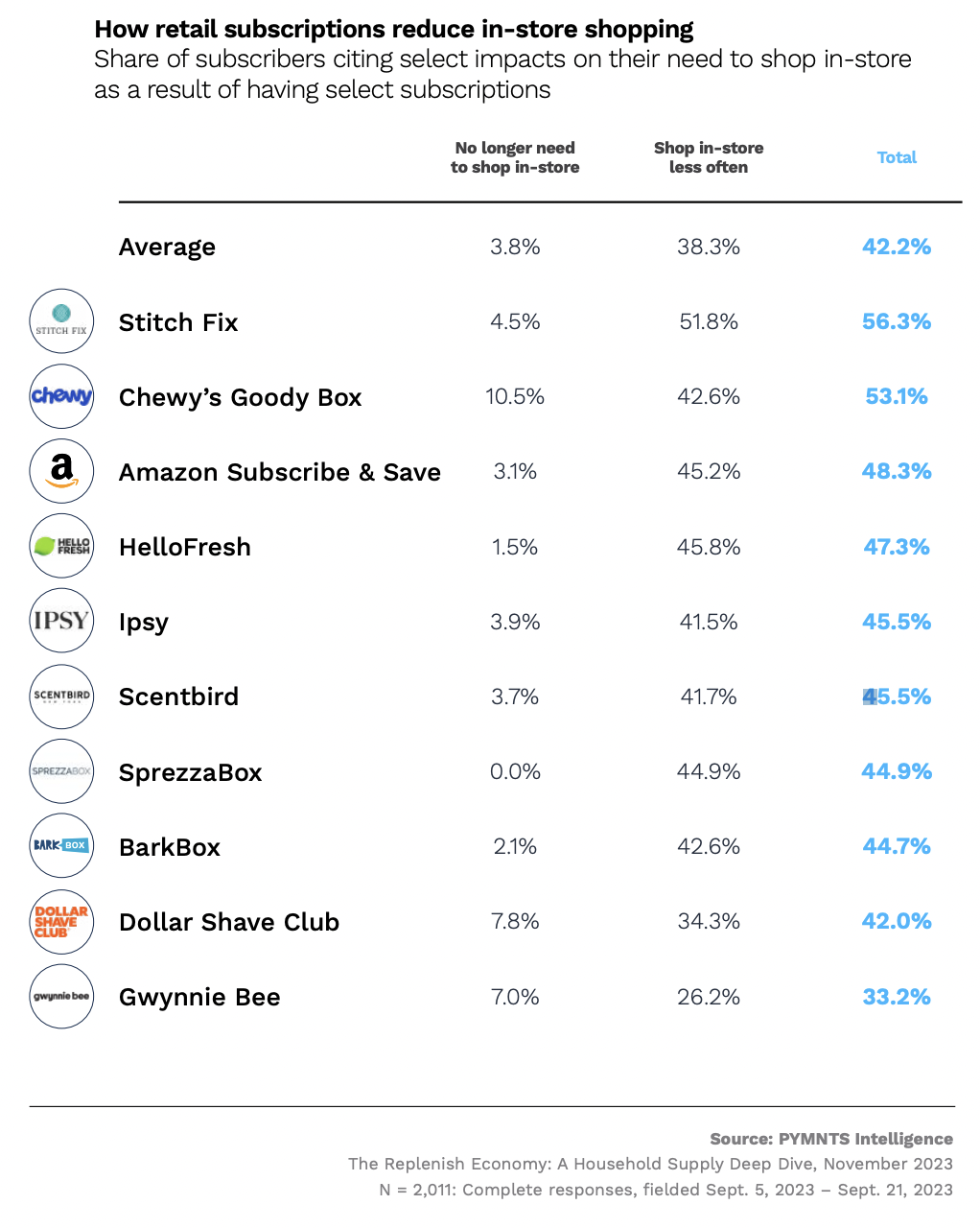

The PYMNTS Intelligence report “The Replenish Economy: A Household Supply Deep Dive” drew from a survey of more than 2,000 U.S. consumers in September to better understand their subscription habits and how these affect their overall shopping behaviors.

The results revealed that among the 15% of retail subscribers participating in Chewy’s Goody Box pet food and toy subscription program, 53% now shop in stores less often, with 11% of participants in the program no longer shopping in stores for these items at all.

The findings suggest that subscription services are altering traditional shopping patterns, leading to a decrease in foot traffic to physical retail locations. This trend indicates a shift toward more convenient and automated ways of obtaining household supplies, driven by the ease and predictability offered by subscription-based models.

The Data in Context

Increasingly, eCommerce players are going after this pet food opportunity. Last year, for instance, meal kit giant HelloFresh announced its new dog food subscription, The Pets Table, promising “human-grade” meals as part of the firm’s push to become the top “fully integrated food solutions group” in the world.

Plus, according to a report from U.K. publication The Telegraph Monday (Feb. 19), British eGrocer Ocado is getting into pet food, launching “fine dining” meals.

In September, U.K. direct-to-consumer brand Butternut Box, which sells dog food subscriptions, announced that it had raised $280 million British pounds (about $353 million) in its latest funding round, with participation from investment firms General Atlantic and existing investor L Catterton.

The rise of digitally native subscription services in the pet supply industry signals a shift in consumer behavior, posing a challenge to traditional brick-and-mortar stores as convenience and automation redefine the retail landscape.