Gen X Turns to BNPL as Student Loan Repayment Trims Discretionary Spend

“Reality Bites” was a touchstone movie for Generation X.

Three decades later, any cinematic foray into the trials and tribulations of those born between 1965 and 1980 might be titled “Student Loans and Inflation Bite — Into the Paycheck.”

For the demographic cohort that followed baby boomers and pre-dated millennials, the assumption might be that there’s stability as a hallmark, at least when it comes to financial standing. After all, Gen Xers have been working for decades. They have kids, and most of their educational journeys have been several years in the rearview mirror.

But as student loan payments resume, those Gen X borrowers with federal educational debt on the books could see their discretionary income trimmed by as much as 8.8%.

Paycheck-to-Paycheck Pressures

The “Generational Deep Dive Edition” of PYMNTS’ ongoing “Paycheck-to-Paycheck” economy reports found that more than two-thirds of Gen X consumers live paycheck to paycheck, and more than one-third of them said their paychecks only cover basic bills. Not surprisingly, for this “sandwich generation” that must often contend with the needs of the kids living at home and the needs of their boomer parents, roughly a third of Gen Xers also said that they pay expenses for other family members. About 60% of them have experienced at least one distressing financial event in the last three years.

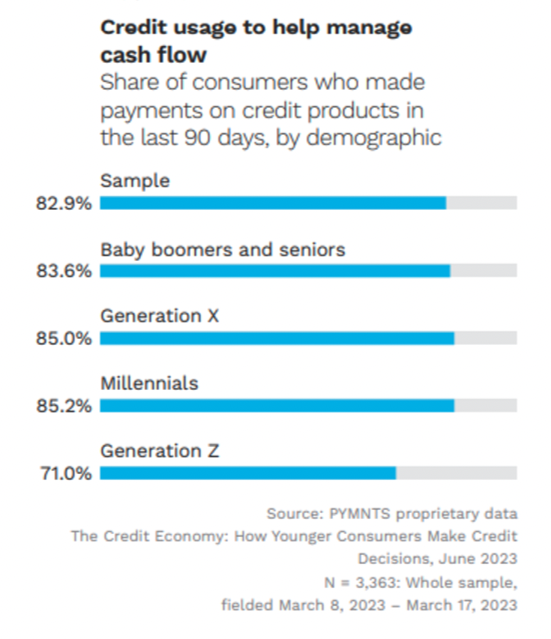

As a result, credit has been a lifeline, but credit is also an obligation. Gen X consumers are among the generations most visibly juggling the demands of credit card debt, as 85% of individuals made credit card payments.

Nearly three-quarters of Gen X respondents PYMNTS tracked reported actively using credit — and 26% have been using credit more often than they had done in the recent past — for everyday purchases.

There has been at least some pivoting to other payment methods — ones that use the available cash on hand. While it is well known that buy now, pay later (BNPL) plans are gaining popularity, the embrace by Gen X signals that there’s a growing awareness that managing everyday spending and everyday cash flow, in tandem, holds its appeal.

As detailed in the June PYMNTS collaboration with i2c, “The Credit Economy: How Younger Consumers Make Credit Decisions,” Gen X has been using BNPL as a strategic tool. Fourteen percent of Gen Xers said they had used BNPL, roughly the same as Generation Z. That’s more than the amount of boomers using BNPL and less than millennials (at about 20%).

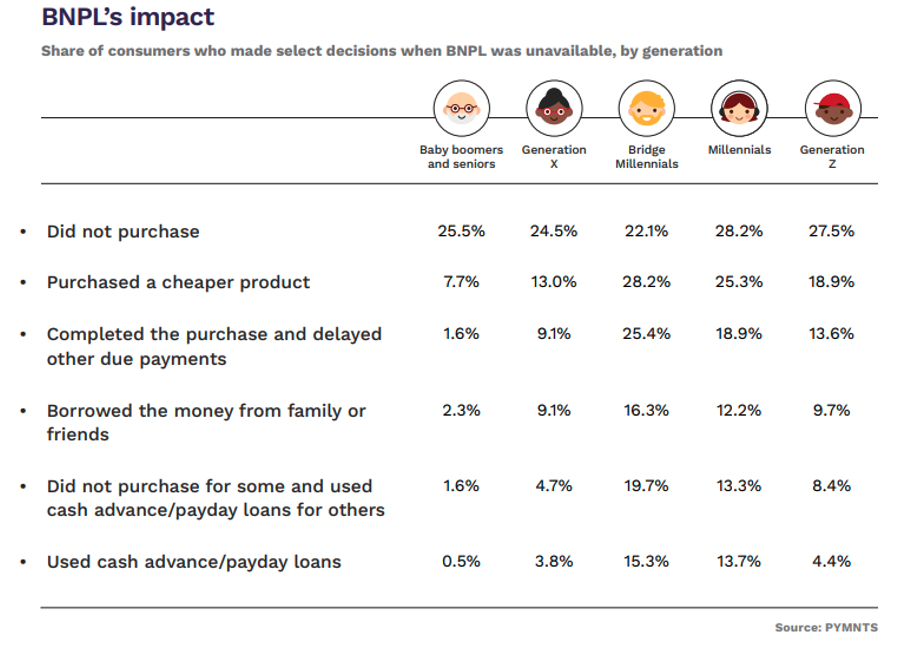

When BNPL is not available, Gen X consumers —nearly one-quarter of individuals — simply opt not to purchase an item or service.

Although Gen X is most likely to use BNPL for clothing, at 21%, the demographic leads all other age cohorts in using the payment option for travel, and Gen X is also only second to baby boomers and seniors in using BNPL for furniture purchases, at 10%.