Turns out Gen X Likes BNPL as Much as Millennials Do

Buy now, pay later (BNPL) plans, in which consumers pay off purchases in a set number of payments and usually interest-free, have gained popularity in recent years.

As detailed in the June PYMNTS collaboration with Sezzle, “The Credit Economy: How Younger Consumers Make Credit Decisions,” uptake rates have varied widely across age demographics.

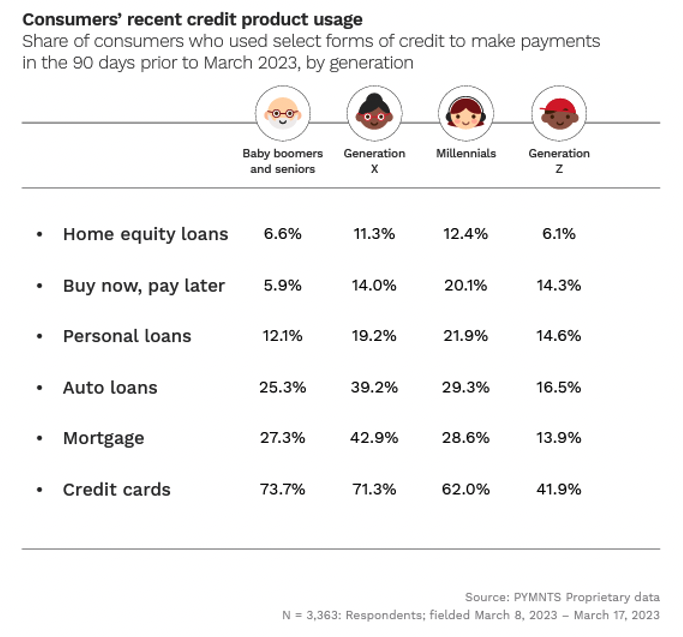

BNPL is generally thought of as a tool for younger consumers. Twenty percent of millennials and 14% of Generation Z consumers used the credit option in the 90 days before being surveyed. However, Generation X, born between 1965 and 1980, proves that stereotype wrong.

Although Gen X’s use of BNPL ties with Gen Z and trails millennial use, the surrounding numbers give important context. Gen X consumers tend to be more likely to use other credit products than consumers in other age demographics. For example, 43% of surveyed Gen X consumers have a mortgage, and 39% have auto loans.

Gen X consumers’ use of BNPL trails their use of personal loans, but they seem to turn to BNPL as an alternative to traditional credit for certain big items to avoid paying interest and to know the items will be paid off in a predetermined short-term period.

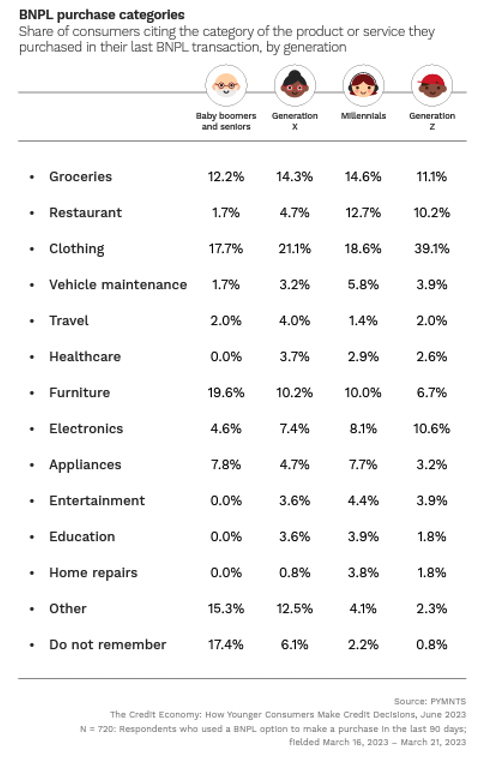

Gen X seems to be using the plans to pay off a mix of both necessary and non-essential larger purchases. Although Gen X is most likely to use BNPL for clothing, at 21%, the demographic leads all other age cohorts in using the payment option for travel, and Gen X is also only second to baby boomers and seniors in using BNPL for furniture purchases, at 10%.

Although those goods are more discretionary, Gen X is using BNPL to pay for essential goods and items as well. These consumers have the highest rate of using BNPL for healthcare at 3.7%, and a similar share use BNPL for education. The comparatively high rate of Gen X using BNPL for these often-large transactions may mean they are using the payment method to pay down these totals owed without the added burden of interest rates — a factor that can be even more important to consumers also tapping other forms of credit at the same time.

Although those goods are more discretionary, Gen X is using BNPL to pay for essential goods and items as well. These consumers have the highest rate of using BNPL for healthcare at 3.7%, and a similar share use BNPL for education. The comparatively high rate of Gen X using BNPL for these often-large transactions may mean they are using the payment method to pay down these totals owed without the added burden of interest rates — a factor that can be even more important to consumers also tapping other forms of credit at the same time.

PYMNTS’ data showed that Gen X’s greater use of credit products compared to other age demographics may partially be driven by the age cohort’s “sandwiched” lifestyle in which they may be supporting both aging parents and growing children. This multi-generational support may be causing Gen X to feel financially stretched, which could get worse as student loans get set to resume in the fall. The monthly payments on the demographic’s outstanding student loan balances of $43,438, on average, represent 8.8% of Gen X’s disposable income.

While Gen X still relies on traditional credit products, BNPL seems to have become an addition to their credit mix, especially for larger purchases. For this generation, incorporating BNPL into their credit product rotation may be the key buffer that allows for these higher transactions to be made while keeping their budgets intact.