As the Number of Payment Methods Consumers Use Increases, So Do Two Key Problems

Inflation continues to rear its ugly head, but PYMNTS’ data finds that some aspects of consumer spending — such as the share of consumers in the United States spending on travel and average retail product spend — are bouncing back.  Also rebounding are payment troubles, such as payment declines and payment fraud, which can cause outsized harm to consumers.

Also rebounding are payment troubles, such as payment declines and payment fraud, which can cause outsized harm to consumers.

“Digital Economy Payments: The Pitfalls Of Payment Diversification” is based on a survey of 2,789 consumers, exploring their payment preferences and evolving shopping behaviors. This report also analyzes current trends in the financial, payments and FinTech landscapes — and where these trends are headed next.

Key findings from the report include:

• After a quick but notable drop, the share of consumers who experienced declined payments and reported fraud rose back up.

• After a quick but notable drop, the share of consumers who experienced declined payments and reported fraud rose back up.

In June, 12% of American consumers experienced a declined payment. Though this represents a rise from 10% in May, looking back further reveals that it nearly matches the exact share from April, also approximately 12%.

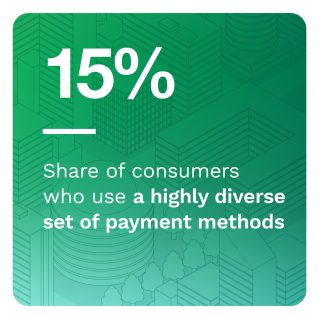

• Payment method diversification can have a downside: Consumers that use multiple payment methods are nearly three times more likely to have payments declined or become victims of fraud.

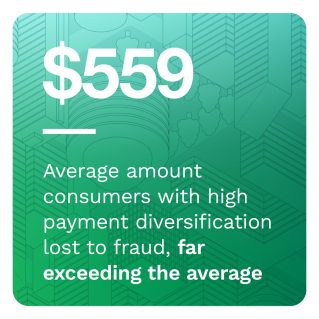

Fifteen percent of consumers that highly diversify their payment methods (consumers who use more than two nontraditional payment methods and at least three in total) were victims of fraud this past month, and 24% of highly diversified consumers had at least one attempted payment declined.

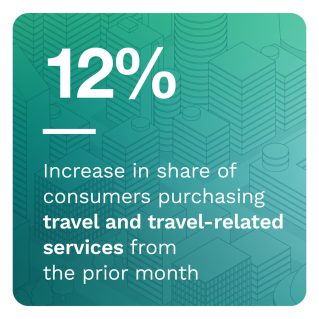

• American consumers are traveling again, and the share purchasing travel and travel-related services has increased by 12% since May.

Likely influenced by upcoming summer vacations, the percentage of consumers making travel purchases has grown from 16% in May to 18% in June. It has not quite recovered to April levels (19%), suggesting that some combination of the price of gasoline, airline staff shortages and the current transmissibility of COVID-19 strains are still impeding travel — or that some summer travelers made their arrangements early this year.

To learn more about these and other trends in the payment and FinTech landscape, download the report.