Debit Cards Are US Consumers’ Favorite Payments Go-To

Consumers’ adoption of new payment methods follows the same pathway to general acceptance as many new products. After launch and initial promotion, word of mouth drives shoppers to check out products that will be successful. These items have their early adopters — the curious individuals willing to experiment — and data shows that nascent payment methods have these critical early adopters as well.

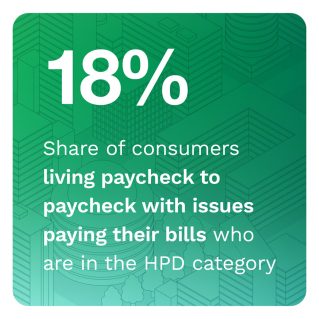

PYMNTS finds that the consumers who are most willing to employ multiple payment methods, a group we define as exhibiting high payment diversification (HPD), tend to be younger, earn higher incomes and have a college education. Overall, 44% of the consumers in this HPD category are millennials, and 41% annually earn more than $100,000. On the other end of the spectrum, low payment diversification (LPD) consumers tend to be older, and 44% of the consumers in this category are baby boomers and seniors.

These are just some of the findings in PYMNTS’ “Digital Economy Payments: Payment Method Diversification,” June 2022 U.S. Edition, based on a census-balanced survey of 2,771 United States consumers conducted between May 10 and May 18. Consumers were asked about the payment methods they use when shopping online and in-store for retail products and groceries.

Some additional key findings include:

Some additional key findings include:

• Eighty-three percent of the consumers classified as HPD use PayPal, making it the most frequently used payment method among the consumers who use three or more forms of payment. Debit cards and credit cards are the next most frequently used methods.

• Seventy-nine percent of HPD consumers use debit cards, and 71% of the consumers in this category use credit cards. Established payment methods still have a strong appeal for many consumers, despite the growing popularity of innovative forms of payment like digital wallets and mobile wallets.

• Forty-four percent of HPD consumers are millennials and tend to be younger and earn more than other survey respondents. HPD consumers’ average age is 43, a full five years younger than the overall survey average. Forty-one percent have annual incomes greater than $100,000.

The number of payment options available to consumers has been increasing for years, and so has consumers’ willingness to employ many of these options. Most consumers still use just one payment method regularly, and the traditional forms of payment like credit cards, debit cards and cash tend to be the most preferred methods. But more innovative payment methods like digital wallets are growing in popularity, especially among the consumers who are most likely to use more than one payment method. At this stage, the more innovative payment methods do not seem to be replacing the established methods like cash and debit cards. Instead, the innovative methods have earned a place alongside established methods among the range of payment options that can be used at the checkout.

To learn more about the payment methods consumers prefer to use at the checkout, download the report.