Emergency Expenses Threaten Consumers as Savings Rates Decline

Meeting short-term and long-term goals is proving onerous as savings rates decline.

But the short term might prove especially hazardous for those of us — and that’s most of us — living in the paycheck-to-paycheck economy.

In the latest edition of “New Reality Check: The Paycheck-To-Paycheck Report,” a PYMNTS and LendingClub collaboration, nearly 4,000 consumers weighed in on the financial stressors of daily financial life.

Holiday shopping is in full swing. The Fed has signaled that interest rates will continue to rise over the next several months. Inflation may be tapering off, but remains stubbornly high, at more than 7%, according to the latest official readings.

And inflation, not surprisingly, is making it harder to meet financial milestones — a reality cited by 57% of respondents.

Looking to Retire but Grappling with Short-Term Goals

Saving for retirement is the main reason consumers set a long-term financial goal and has been cited by roughly 60% of the consumers we’ve queried. Drill down just a little, and more than 32% of consumers say their goals include building up savings for emergencies. Only 7% of consumers living paycheck to paycheck with issues paying their bills list this as a key reason for setting long-term goals. About 15% say this is on their long-term roadmap, which indicates, in turn, that the pressures of dwindling savings make that goal a bit out of reach. In the meantime, 31% of paycheck-to-paycheck consumers state that paying off debt is their most important short-term goal.

But being able to do so presents, and will continue to present, a challenge with 48% of P2P individuals with issues paying bills stating that they are not saving and do not have savings, a segment that includes 15% of consumers living P2P without issues covering the monthly nut.

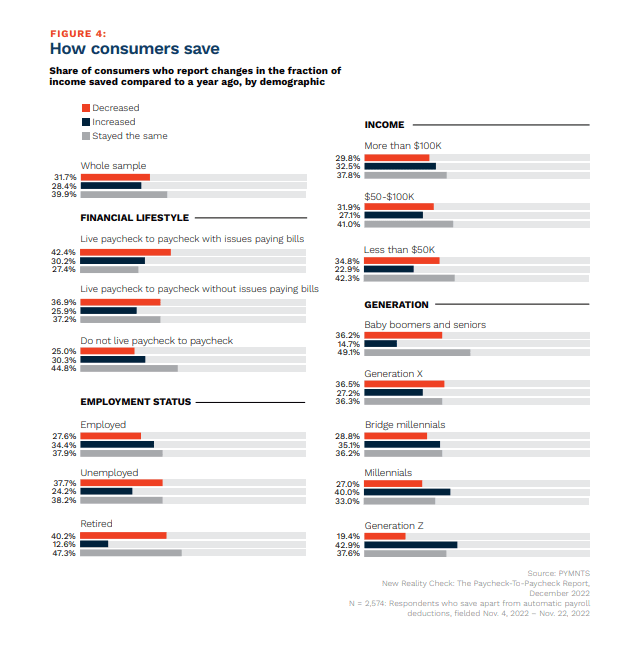

As evidenced in the chart below, for the consumers that have been saving, a significant percentage of them are finding that their savings rates are decreasing — for 31% of the overall population and 42% of P2P individuals struggling with bills.

The PYMNTS data dovetails with recent releases from the Bureau of Economic Analysis, which found that the U.S. personal savings rate dropped in October to 2.3%. That’s the lowest rate at about 17 years. The fact remains that we’re running harder to stay in place or backsliding a bit.

It’s become shorthand for researchers and media to cite the stat that many consumers can’t handle an unexpected $400 expense. But this past fall, separate research from PYMNTS/LendingClub found that

46% of emergency expenses cost over $400, averaging roughly $1,400.

There’s not much breathing room, not much room for error as cash cushions decline, and the paycheck-to-paycheck consumer will be hardest hit.