Half of Financially Distressed Consumers Plan to Finance Holiday Purchases

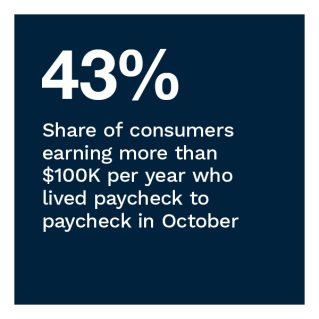

With the shock waves of inflation continuing to weaken spending power, most United States consumers are toning down their expectations for the 2022 holiday shopping season. One month ahead of the start of the season, 60% of U.S. consumers live paycheck to paycheck, an increase of 4 percentage points from October 2021, according to PYMNTS’ research. Middle-income consumers saw the steepest increase in paycheck-to-paycheck status, jumping 7 percentage points in the past year to 65%.

Our data also finds that 15 million — or 5.8% of — U.S. consumers who shopped for holiday gifts in 2021 do not plan to do so this year. Just 79% of consumers overall plan to shop for the 2022 holiday season, representing a 10% decrease from 88% in 2021. Paycheck-to-paycheck consumers who have issues paying their bills are expected to see the steepest decline, with 17% fewer consumers in this category planning to shop this year.

Spending for family gatherings will likely remain a part of consumers’ holiday budgets in 2022, despite rising food prices. Consumers expect to cut back their spending on gifts and entertainment, but not so much on groceries. For their holiday spending, some consumers are turning to financing, particularly those living paycheck to paycheck.

These are just some of the findings detailed in this edition of “New Reality Check: The Paycheck-To-Paycheck Report,” a PYMNTS and LendingClub collaboration. The Holiday Shopping Edition examines the financial lifestyles and spending choices of U.S. consumers going into the 2022 holiday shopping season. The series draws on insights from a survey of 3,462 U.S. consumers that was conducted from Oct. 6 to Oct. 24, as well as analysis of other economic data.

The Holiday Shopping Edition examines the financial lifestyles and spending choices of U.S. consumers going into the 2022 holiday shopping season. The series draws on insights from a survey of 3,462 U.S. consumers that was conducted from Oct. 6 to Oct. 24, as well as analysis of other economic data.

Key findings from the study include:

• Rising food costs are not likely to curtail family gatherings and dinners, but spending on groceries will leave less for gifts and entertainment. Nonessential spending, such as restaurant dining and leisure activities, is where consumers are most likely to tighten their belts. According to PYMNTS’ research, close to half of all consumers say the holiday season increased their retail and grocery spending. In fact, 49% of consumers who purchased retail goods during the 2021 holiday season and 46% of those who purchased groceries for holiday events spent more during that period compared to the rest of the year.

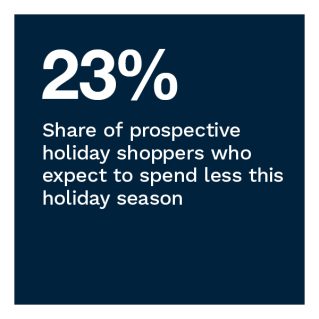

• Low prices and discounts will drive more of shoppers’ holiday spending in 2022 than convenience.  Paycheck-to-paycheck consumers are the most likely to make their holiday shopping plans based on budgetary reasons. PYMNTS’ research finds that 43% of consumers who plan to spend more this year cite price increases as the reason for their increased spending. Even with higher prices, however, 23% of consumers planning to shop in 2022 expect to decrease the dollar value of their purchases. Low prices and discounts will determine where 44% of shoppers make their holiday purchases. Our data also finds that 81% of paycheck-to-paycheck consumers decide where to make their holiday purchases due to budgetary reasons, compared to 77% of consumers not living paycheck to paycheck.

Paycheck-to-paycheck consumers are the most likely to make their holiday shopping plans based on budgetary reasons. PYMNTS’ research finds that 43% of consumers who plan to spend more this year cite price increases as the reason for their increased spending. Even with higher prices, however, 23% of consumers planning to shop in 2022 expect to decrease the dollar value of their purchases. Low prices and discounts will determine where 44% of shoppers make their holiday purchases. Our data also finds that 81% of paycheck-to-paycheck consumers decide where to make their holiday purchases due to budgetary reasons, compared to 77% of consumers not living paycheck to paycheck.

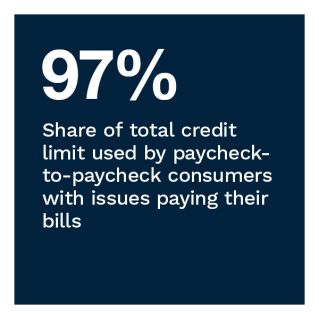

• Nearly four in 10 holiday shoppers intend to use financing — such as credit cards, personal loans and buy now, pay later — to pay for one or more of their holiday purchases in 2022. PYMNTS’ research finds that 37% of shoppers intend to use financing to pay for one or more of their holiday purchases in 2022, a slightly higher share than the 34% who used financing in 2021. The likelihood that consumers will use financing increases based on financial distress. Among paycheck-to-paycheck consumers with issues paying their monthly bills, 52% plan to finance at least one purchase during the 2022 holiday season, up from 47% who used financing during the 2021 holiday season. This share is slightly lower among consumers living paycheck to paycheck without issues paying their bills: 42% plan to finance at least one purchase, up from 39% last year.

To learn more about how inflationary pressures will impact holiday spending among paycheck-to-paycheck consumers, download the report.