New Survey Shows Consumers Less Optimistic Than Fed on Taming Inflation

Consumers have to make tough choices about their spending.  Just 4% of consumers say that their wages have kept pace with inflation, so it is safe to say most consumers are feeling the pinch — a reality that might explain their increasingly negative perceptions toward the economy. In fact, nearly 3 in 10 U.S. consumers believe that a recession is already occurring, and 70% say that the rising cost of essentials such as groceries, housing and fuel forces severe cutbacks on discretionary spending.

Just 4% of consumers say that their wages have kept pace with inflation, so it is safe to say most consumers are feeling the pinch — a reality that might explain their increasingly negative perceptions toward the economy. In fact, nearly 3 in 10 U.S. consumers believe that a recession is already occurring, and 70% say that the rising cost of essentials such as groceries, housing and fuel forces severe cutbacks on discretionary spending.

For the August edition of “Consumer Inflation Sentiment: Inflation Slowly Ebbs, But Consumer Outlook Remains Gloomy,” PYMNTS surveyed 2,169 consumers to uncover the spending changes they have made and understand their motivations — as well as their perceptions of how much more severe the situation may become.

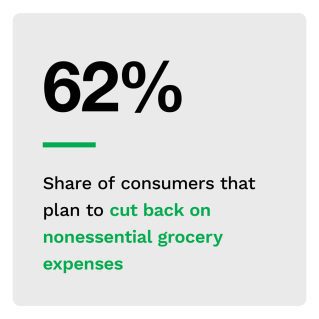

• Consumers say that the rising cost of essentials such as groceries, housing and fuel forces severe cutbacks on discretionary spending, and 70% of U.S. consumers surveyed have cut down on nonessential retail spending.

• Consumers say that the rising cost of essentials such as groceries, housing and fuel forces severe cutbacks on discretionary spending, and 70% of U.S. consumers surveyed have cut down on nonessential retail spending.

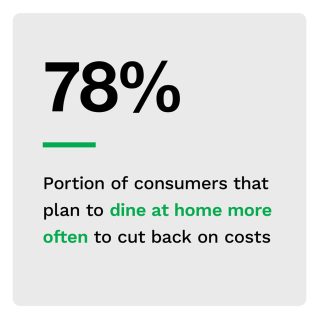

Consumers are being forced to make tough choices about what they need, what they want and what is simply “nice to have.” Nonessential items — especially those from the retail and travel industries — are taking a back seat to essentials such as food and shelter.

• The average consumer still expects high inflation to last until May 2024, despite the recent modest decreases in month-over-month inflation.

The average consumer expects inflation to continue at its current rate for more than 22 months into the future. Consumers living paycheck to paycheck with issues paying bills are the most pessimistic, with 28% saying they believe inflation will continue at its current rate for longer than two years.

• Nearly 3 in 10 consumers think we are already in a recession. Consumers’ perceptions are shaped by the impact of inflation and labor conditions within their own personal ecosystem, regardless of what economists say.

The purchasing power of the U.S. dollar has dropped about 12% over the last two years — and for many consumers, the very real impact on their spending power outweighs any positive news from the Fed.

These findings — and others — indicate that many Americans are growing increasingly concerned about their ability to make ends meet and their financial futures.

To learn more about how inflation is impacting consumer sentiment, download the report.