Paycheck-to-Paycheck Consumers Have Good Credit Scores, Show More Credit Savvy

Characterized by weakened spending power and mounting economic uncertainty, 2022 has been an economic roller coaster. Due to rising costs, growing numbers of consumers spend all they earn on living expenses each pay period and need their next paycheck to meet upcoming financial obligations.

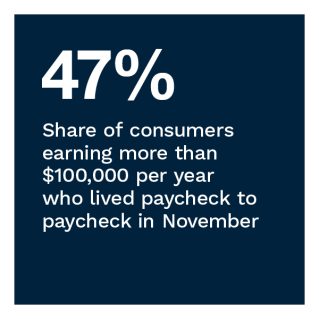

Living paycheck to paycheck has become more of a reality even for high-income consumers this year. Although many paycheck-to-paycheck consumers can manage their cash flows enough to consistently pay their bills, one in five United States consumers struggle to make ends meet.

Not surprisingly, consumers’ ability to save has taken a hit. PYMNTS’ research finds that 32% of all consumers report diminished saving capacity compared to a year ago, with 42% of paycheck-to-paycheck consumers with issues paying their monthly bills saying their ability to save has decreased. Thirty-seven percent of paycheck-to-paycheck consumers living without issues paying bills agree they are less able to save, and just 25% of consumers not living paycheck to paycheck say their ability to save has decreased.

These are just some of the findings detailed in “New Reality Check: The Paycheck-To-Paycheck Report: 2022 Year In Review,” which examines how 2022’s inflation and economic uncertainty have impacted U.S. consumers, especially those who spend all their income on monthly expenses.  Drawing from a PYMNTS series of 12 unique reports issued each month from January to December, conducted in partnership with LendingClub and representing insights from a total of 45,700 U.S. consumers, this special edition reviews how consumers navigated the ongoing financial pressures of this year’s ever-changing economic landscape.

Drawing from a PYMNTS series of 12 unique reports issued each month from January to December, conducted in partnership with LendingClub and representing insights from a total of 45,700 U.S. consumers, this special edition reviews how consumers navigated the ongoing financial pressures of this year’s ever-changing economic landscape.

More key findings detailed further inside include:

• Growth in the paycheck-to-paycheck consumer population has been headlined by those annually earning more than $100,000, and 63% of U.S. consumers say they need their next paycheck to pay their bills. The share of consumers living paycheck to paycheck has fluctuated throughout the past year. Although this share is currently similar to the 64% it measured a year ago, it is up 11 percentage points from an April 2021 low. Although consumers of all income brackets have been feeling the financial crunch, the share of high-income consumers living paycheck to paycheck has been particularly on the rise in the past two years. In November, 47% of consumers annually earning more than $100,000 reported living paycheck to paycheck — a 13 percentage point increase from a July 2021 low.

• The rising prices of non-discretionary items, coupled with wage stagnation, are putting consumers in a difficult financial position. Consumers living on tighter budgets allocate a disproportionate share of their spend to groceries; rising grocery prices are increasingly eroding their ability to save. Most consumers across all financial lifestyles have purchased groceries and fuel in the last 30 days, two of the segments inflation has impacted most this year. As rising prices continue to impede their ability to save, consumers’ financial lifestyles influence what they consider essential. For instance, paycheck-to-paycheck consumers with issues paying their bills are significantly less likely to purchase fuel for a car than paycheck-to-paycheck consumers living without issues paying bills, at 72% versus 80%.

• The rising prices of non-discretionary items, coupled with wage stagnation, are putting consumers in a difficult financial position. Consumers living on tighter budgets allocate a disproportionate share of their spend to groceries; rising grocery prices are increasingly eroding their ability to save. Most consumers across all financial lifestyles have purchased groceries and fuel in the last 30 days, two of the segments inflation has impacted most this year. As rising prices continue to impede their ability to save, consumers’ financial lifestyles influence what they consider essential. For instance, paycheck-to-paycheck consumers with issues paying their bills are significantly less likely to purchase fuel for a car than paycheck-to-paycheck consumers living without issues paying bills, at 72% versus 80%.

• Credit products are a cash flow management tool for paycheck-to-paycheck consumers — indicating that many remain creditworthy. PYMNTS’ data shows that paycheck-to-paycheck consumers are likely to use credit cards and personal loans. Based on credit card payments in the past 90 days, credit card utilization rates range from 48% among struggling paycheck-to-paycheck consumers to 62% among those living without difficulty. Personal loan use among paycheck-to-paycheck consumers sits at approximately 21%, regardless of their ability to pay bills — indicating that many can manage their cash flow.

To learn more about how inflationary pressures impacted U.S. consumers living paycheck-to-paycheck consumers in 2022, download the report.