NEW DATA: US Consumers Face Emergency Expenses 3.5x Larger Than Fed Estimates

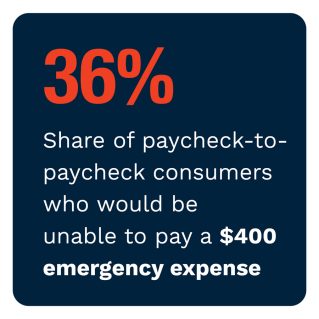

In May 2022, the Federal Reserve released the Economic Well-Being of U.S. Households in 2021, the latest edition of an annual report often used in measuring financial health. Since 2013, these reports have tracked consumers’ stated ability to afford a theoretical $400 emergency expense. While the economy has evolved rapidly over the past nine years, that $400 benchmark has remained stagnant, raising the question: Should that figure be updated to reflect today’s reality?

PYMNTS’ data finds that this is not just a thought exercise: Nearly half of U.S. consumers have faced at least one unexpected expense in the last 90 days, with 56% of emergency expenses costing more than $400. In fact, consumers’ average emergency expense was approximately $1,400.

Additionally, living paycheck to paycheck is becoming the norm, and as many consumers now live paycheck to paycheck without issues paying bills as those who do not live paycheck to paycheck. The affluent are not immune to these trends, either, as the share of high-income consumers living paycheck to paycheck has increased in the past year.

These are just some of the findings detailed in this edition of “New Reality Check: The Paycheck-To-Paycheck Report,” a PYMNTS and LendingClub collaboration. The Emergency Spending Edition examines the financial lifestyle of U.S. consumers who live paycheck to paycheck, the factors that cause financial distress and how financial stressors, such as emergency spending, impact their ability to manage expenses and put aside savings. The series draws on insights from a survey of 4,006 U.S. consumers conducted from July 8 to July 27, as well as an analysis of other economic data.

More key findings from the study include:

• More than half of all U.S. consumers currently live paycheck to paycheck, and increasing numbers of high-income consumers are falling into this financial lifestyle. Our research finds that 59% of U.S. consumers lived paycheck to paycheck in July 2022, a slight short-term decrease from 61% in June. Over the last 12 months, however, this share has trended upward, increasing from 54% in July 2021.

Though the share of consumers living paycheck to paycheck across income levels has fluctuated, it has also trended upward, especially for those in higher income brackets. In the past year, for instance, the share of consumers earning $100,000 or more annually and living paycheck to paycheck has risen 9 percentage points from 34% in July 2021 to 43% in July 2022.

• Nearly half of U.S consumers have had to pay at least one emergency expense in the last 90 days, especially among high-earning demographics. PYMNTS’ research finds that 46% of consumers were forced to pay for at least one unexpected expense, with consumers apt to face multiple. In fact, we found an almost even split between those having faced one emergency expense (22%) and those having faced more than one expense (24%). Our data also shows middle-aged and high-income consumers are more likely to have faced emergency expenses.

•  Car repairs are the most common emergency expense, and many consumers also experienced unexpected expenses related to health and housing. Common emergency expenses include everything from car repairs to health-related costs and housing and relocation expenses. At 30%, car repairs are the most common unexpected expense, and consumers paid an average of $1,000 for them.

Car repairs are the most common emergency expense, and many consumers also experienced unexpected expenses related to health and housing. Common emergency expenses include everything from car repairs to health-related costs and housing and relocation expenses. At 30%, car repairs are the most common unexpected expense, and consumers paid an average of $1,000 for them.

The next-most common expenses are health-related, with 21% of consumers who had at least one emergency expense facing them and paying an average of $1,361. Housing- and relocation-related expenses had the highest average cost at $2,000, and 19% of consumers faced this expense. Car repair expenses were more common among consumers living paycheck to paycheck and lower-income consumers.

Though the Federal Reserve has been tracking consumers’ ability to pay a $400 emergency expense as an indicator of financial distress for over a decade, this indicator may be losing relevance amid rising inflation and the increasing cost of common emergency expenses.

To learn more about how emergency expenses impact paycheck-to-paycheck consumers, download the report.