60% of Cash-Strapped Consumers Still Splurge on Nonessentials

In today’s consumer-driven society, it is not uncommon for individuals, even those living paycheck to paycheck and struggling to pay bills, to indulge in occasional splurges.

These splurges, often involving nonessential items, provide a sense of enjoyment and satisfaction, according to findings detailed in the “The Paycheck-to-Paycheck Report: The Nonessential Spend Deep Dive Edition.”

The joint PYMNTS-LendingClub study reveals that a significant majority of consumers, approximately 74%, admit to including nonessential items in their grocery carts at least some of the time. Similarly, 70% of consumers report the same behavior when it comes to retail shopping.

Consumers who are not living paycheck to paycheck appear to splurge on nonessential items more frequently, with 85% and 78%, respectively, leaning towards grocery and retail shopping.

Even among consumers who are living paycheck to paycheck without issues paying their bills, a significant share still engage in splurges. Approximately 72% of these individuals admit to buying “nice-to-have” grocery items at least sometimes, while 69% report the same behavior for retail items. Furthermore, among those who struggle to pay their bills, nearly 60% acknowledge occasionally purchasing nonessential grocery or retail items.

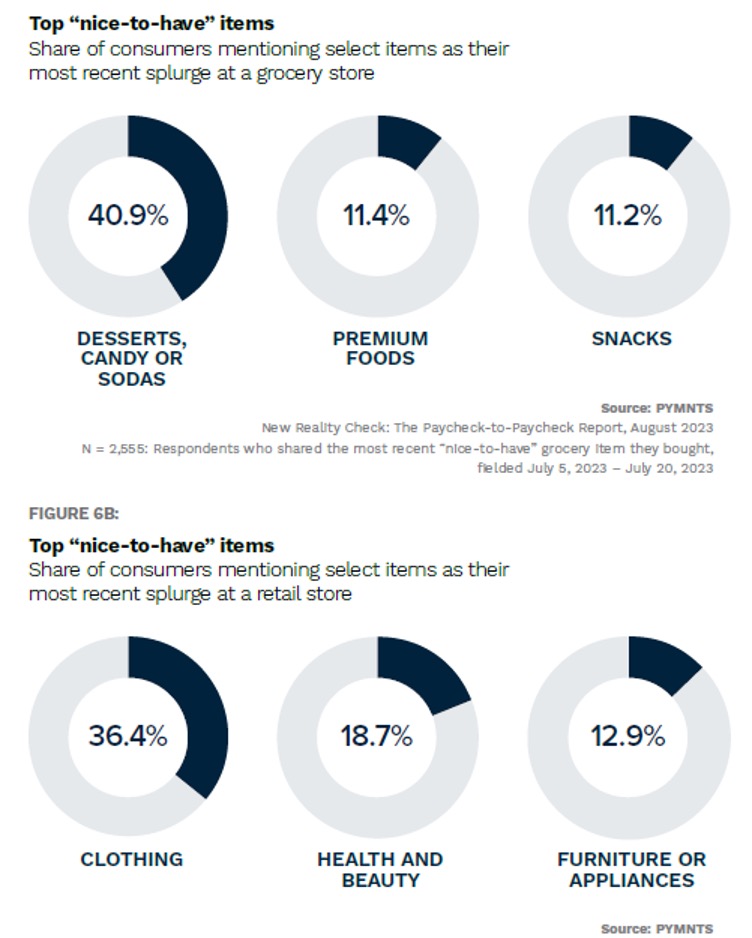

When it comes to grocery splurges, desserts, candy and sodas are the top choices for four out of ten shoppers. Premium goods, such as imported foods or seafood, and snacks follow, but at a distance, with both being cited by about 11% of grocery shoppers.

On the other hand, clothing takes the lead as the most frequently purchased non-grocery splurge item, with 36% of consumers indulging in this category. Health and beauty products come in second place, with 19% of consumers splurging on these items.

Interestingly, the data suggests that the categories of nonessential purchases do not vary significantly across different financial lifestyles. Whether consumers are living paycheck to paycheck or not, their splurges tend to fall within similar categories. However, consumers who are not living paycheck to paycheck are more likely to splurge on premium foods.

Overall, despite financial constraints, it is evident that most consumers, including those living paycheck to paycheck and struggling to pay bills, occasionally indulge in splurges. Understanding these consumer behaviors can provide valuable insights for businesses and marketers seeking to cater to consumer preferences and capitalize on these splurge tendencies.