Unexpected Life Events Throw Many Consumers Into Credit Insecurity

Bank charge-off rates indicate possible trouble on the horizon as consumers increasingly miss monthly payments.

It can take just a single life event to turn someone’s world upside down — be it a job loss, long-lasting illness or natural disaster. These crises can have wide-ranging ripple effects for those impacted, including personal finance difficulties and diminished creditworthiness.

Although oftentimes these events are random or uncontrollable, such events may usher in a cascading effect of related financial woes. One missed payment leads to extra fees and may result in a lower credit score. A lower credit score in turn may increase the likelihood that future loans carry higher interest and penalties than might have been offered previous to the negative life event.

As consumers struggle to keep up with rising costs and rates, wages continue to not keep up with inflation and other supplemental benefits such as SNAP cuts, these life events may be occurring on a mass scale. And as noted in PYMNTS’ collaboration with Sezzle, “How Credit Insecurity is Changing U.S. Borrowing Habits,” negative life events have led even those considered fully able to access credit — the credit secure — to miss payments.

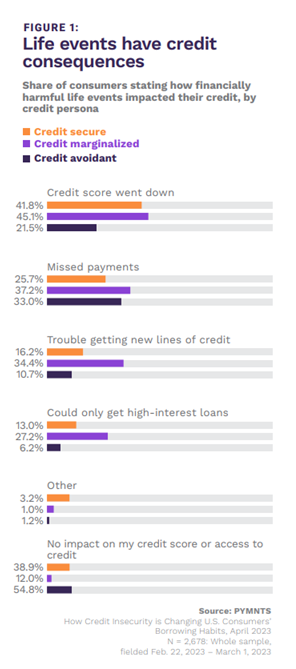

Financially damaging life events can clearly have a significant impact on consumers’ personal finances. Our report analyzed the credit secure, the credit marginalized (those who had been rejected from at least one credit product in the past year) and the credit avoidant (those who have given up on credit entirely).

As the graph demonstrates, 16% of credit-secure consumers noted that these life events led to them having trouble getting new lines of credit — particularly meaningful because this consumer category is defined by their superior ability to access credit. Approximately one-quarter of this group missed payments as a result, leading to the cascade effect mentioned above. (This effect is not just hypothetical; our data found indicators of this occurring among the credit marginalized and avoidant.)

To deal with these life events, consumers may be ignoring these possible pitfalls as charging continues to rise, possibly because there little other choice. This charge-first behavior was reflected in Mastercard’s recent earnings release, noting that in the U.S., dollar volumes gained 9% to reach $673 billion. Stateside credit volume ballooned nearly 15% to $343 billion, leading Mastercard CEO Michael Miebach to remark during an analyst conference call that “consumer spending has remained remarkably resilient.”

American Express has seen similar numbers, reporting U.S. consumer volumes up 16%, representing 3.4 million cards acquired in the first quarter of 2023. This would seem like good news, except credit card charge-offs overall are also creeping up, from an average of 2.46% in February to 2.60% in March.

The country’s biggest banks wrote off $3.4 billion in bad loans during Q1 2023, a 73% jump year over year. In a statement accompanying JPMorgan’s earnings, Chairman and CEO Jamie Dimon noted, “The storm clouds that we have been monitoring for the past year remain on the horizon, and the banking industry turmoil adds to these risks.”

If Dimon’s viewpoint proves correct, consumers’ credit card use rate and continued larger charge-offs may indeed be a factor in a stormier future economic landscape as these collective life events possibly continue. While there are no guarantees, these and future delinquency rates may be one more signal of what may lie ahead.