Consumers Have Covered Credit Card Bills So Far, but Defaults Loom

Until recently, consumers were largely paying off cards and other loans. Current headwinds may change that.

It is a testament to consumer resiliency that credit card late payments and other delinquencies have remained low for so long, despite the prolonged challenge of doing more with less. With individual and global headwinds including wages failing to keep pace with rising prices and curbing inflation taking longer than predicted, it seems remarkable that charge-offs and write-offs reported by banks hovered at manageable levels. This repayment rate was recently illustrated in the PYMNTS collaboration with Elan Financial Services, “Credit Card Use During Economic Turbulence.”

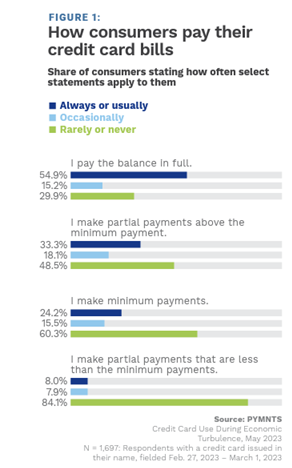

As depicted in the chart, 45% of surveyed consumers make only minimum or partial payments, leaving themselves vulnerable to rising rates. Perhaps this factor alone wouldn’t be cause for repayment concerns, even as credit card debt tops $1 trillion, as this means 55% of consumers pay their balance in full monthly. However, other recently surfaced stumbling blocks may impact consumers’ ability to keep up.

Hints that the tide may have turned with credit card repayment rates came as the country’s six largest banks recently reported the highest rates of loan loss since the pandemic began. Analysts have projected these banks will write off a combined $5 billion in defaulted loans over Q2 2023. Credit card repayments have been hardest hit, with Chase card charge-offs amounting to $1.1 billion, compared to $600 million during the same period last year. Wells Fargo also saw its provision for credit losses in consumer banking and lending reach $874 million, up from $613 million last year. The bank’s credit card loan 30 day+ delinquency rate reach 2.4%, compared to 1.5% last year. This follows June’s news of credit card delinquency rates eclipsing pre-pandemic levels for Capital One and Discover.

Slipping repayments are of particular concern, as many consumers have so far kept current with credit card bills through the recent economic turbulence by carrying a revolving balance.

One challenge that may affect consumers ability to keep up with card payments is the mounting pressure to make the minimum as interest compounds on a rising or perhaps maxed out loan line. The most inflation-stressed consumers, categorized by PYMNTS as living paycheck to paycheck with issues managing bills, have been missing due dates since at least the start of 2023. And for subprime borrowers as well as consumers across financial lifestyles, limits are being hit as savings can’t be further stretched. What has changed over the last reported quarter, it seems, is that consumers across multiple brackets without issue before may now have trouble paying bills.

Adding further to these pressures are rising layoffs, the loss of SNAP benefits affects 25 million consumer budgets, along with the resumption of student loan payments, predicted to impact many more borrowers’ spending power. Considering other unexpected life events perhaps throwing consumers into financial and personal distress, and it may be a wonder, then, that many were able to maintain their repayment rates for so long.

Along with other individual challenges, any combination of these financial hurdles could cause consumer to slip in making monthly payments on time. If these hardships should happen all at once, as could be now, the economic landscape may be in for a far bumpier ride than previously expected.