Nearly Two-Thirds of Struggling Consumers Revolve Credit Card Balances

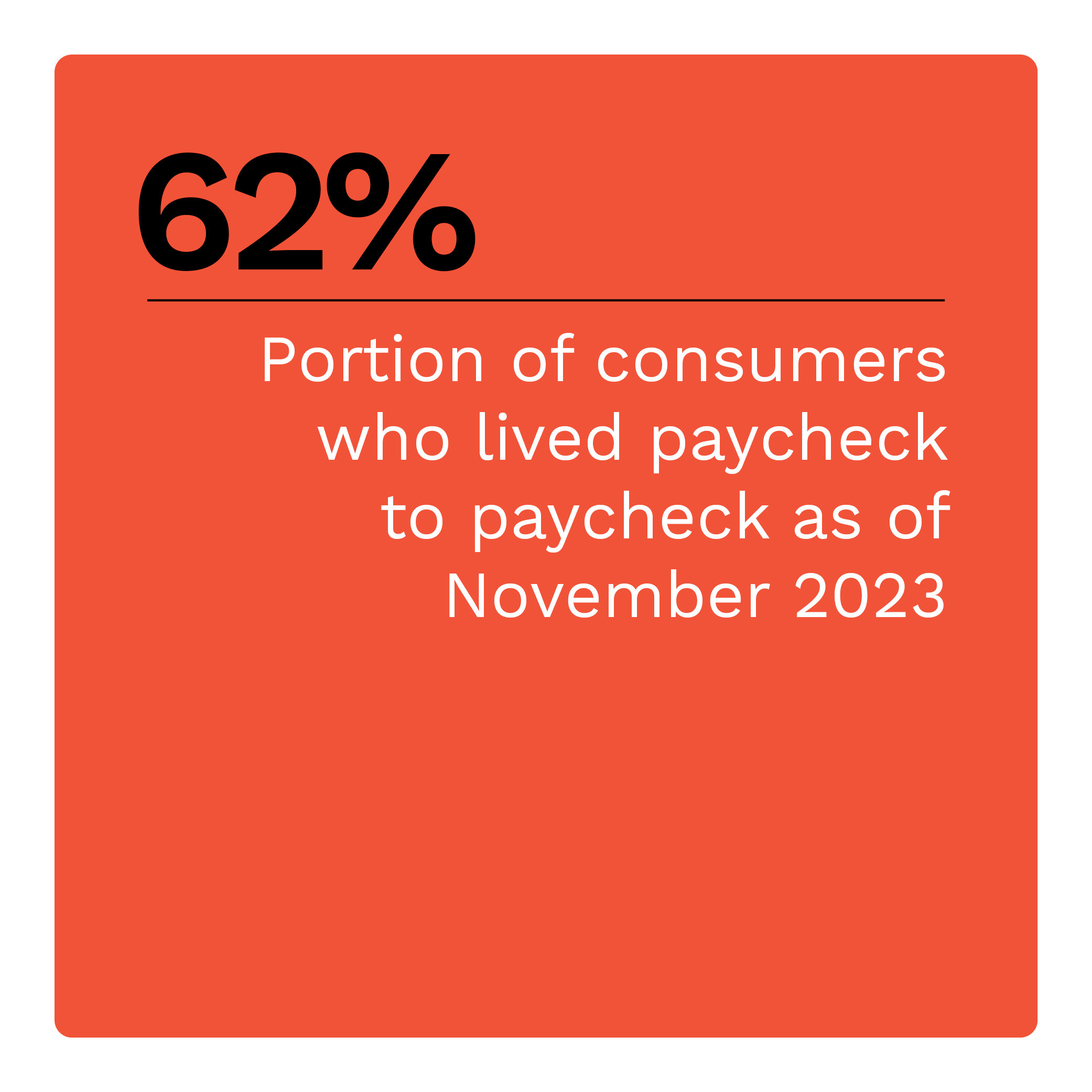

The holiday season has offered little reprieve from the rising prices of goods and services still weighing on consumers’ wallets. Many consumers use credit cards as a cash flow management tool. As of November 2023, 62% of consumers lived paycheck to paycheck, with 20% struggling to pay their monthly bills. These shares are virtually unchanged from last year, indicating that consumers have adjusted to the current economic environment, even as their financial obligations continue to exceed incomes.

Among consumers living paycheck to paycheck, 40% report having super-prime credit scores. Eighty percent of those living paycheck to paycheck use credit cards and hold two cards, on average. Data shows that financial distress is closely associated with a higher frequency of reaching one’s credit limit and carrying balances from month to month. It may come as no surprise that paycheck-to-paycheck consumers value features such as higher credit limits and split payment plans when choosing a card.

These are just some of the findings detailed in this edition of “New Reality Check: The Paycheck-to-Paycheck Report,” a PYMNTS Intelligence and LendingClub collaboration. “The Credit Card Use Deep Dive Edition” examines the financial lifestyles of U.S. consumers and explores how they use credit cards to manage their cash flows to get by. This edition draws on insights from a survey of 3,252 U.S. consumers conducted from Nov. 6 to Nov. 22 and an analysis of other economic data.

Other key findings from the report include:

Financially struggling consumers hold fewer credit cards.

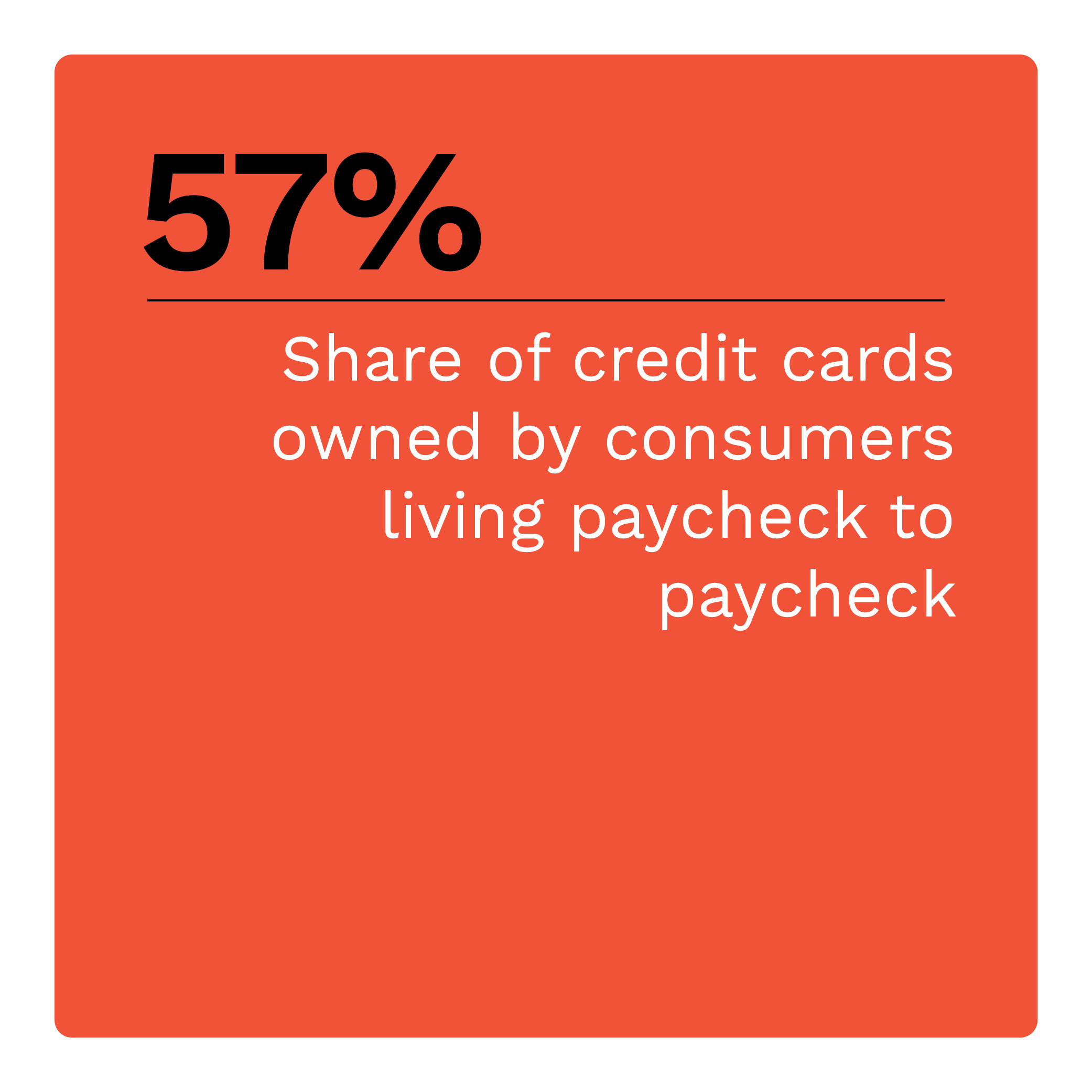

Still, consumers living paycheck to paycheck own nearly 60% of credit cards in the U.S. PYMNTS Intelligence finds that paycheck-to-paycheck consumers with issues paying monthly bills hold 17% of credit cards. Those without issues paying bills hold 40%. Paycheck-to-paycheck consumers are more likely to use debit cards than credit cards for everyday transactions. Just 20% of credit card holders in this group reported using a one for their last purchase. This usage shows that though paycheck-to-paycheck consumers have access to credit, they aim to live within their means and preserve that flexibility.

Paycheck-to-paycheck consumers are just as likely to value a good credit score.

Living paycheck to paycheck does not stop consumers from having high credit scores. Forty-nine percent of consumers living paycheck to paycheck without issues paying their monthly bills report having super-prime credit scores. Twenty-two percent of paycheck-to-paycheck consumers with issues paying their bills say the same. Paycheck-to-paycheck consumers are managing their card use to stay creditworthy, and many are successful even as those struggling the most tend to find it more challenging.

Living paycheck to paycheck does not stop consumers from having high credit scores. Forty-nine percent of consumers living paycheck to paycheck without issues paying their monthly bills report having super-prime credit scores. Twenty-two percent of paycheck-to-paycheck consumers with issues paying their bills say the same. Paycheck-to-paycheck consumers are managing their card use to stay creditworthy, and many are successful even as those struggling the most tend to find it more challenging.

Different consumers value different aspects when choosing credit cards.

Paycheck-to-paycheck consumers choose credit cards for their financing features, while those not living paycheck to paycheck value them more for their security and rewards options. Struggling paycheck-to-paycheck consumers are more likely to cite interest rates and credit limits as very or extremely important when choosing a primary credit card. This choice implies that struggling consumers may rely on credit cards for emergencies. Those not living paycheck to paycheck view credit cards as just another payment method.

U.S. consumers continue to live on tighter budgets due to ongoing inflation. Credit cards are a tool that many use to manage cash flows. Download the report to learn how consumers living paycheck to paycheck use credit cards to manage spending while remaining creditworthy.