New Report Finds the Average Consumer Is Overdrawn for 9 Days

Present economic and financial challenges have compelled individuals from various income brackets and credit backgrounds to resort to overdrafts — a form of credit whereby a consumer’s bank covers a transaction or withdrawal when there isn’t enough money in an account.

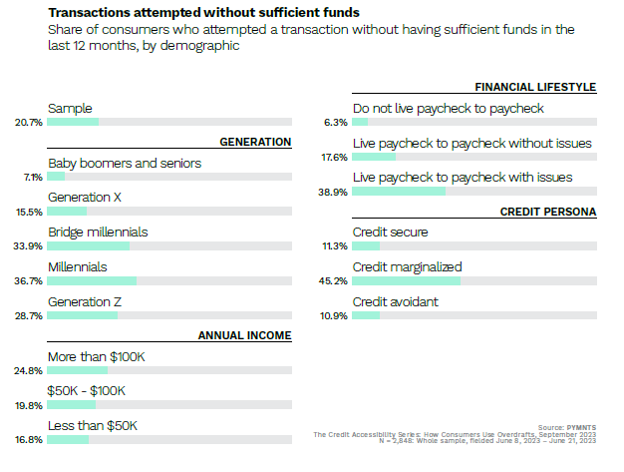

In the past year, for example, 20% of consumers used overdrafts due to insufficient funds in their bank accounts, with nearly half of credit marginalized consumers experiencing these situations.

But overdrafts come at a cost, as noted in “The Credit Accessibility Series: How Consumers Use Overdrafts” report which examines consumer behaviors and sentiments related to the use of overdrafts based on a survey of more than 2,800 consumers in the United States.

According to the data captured in the study done jointly by PYMNTS Intelligence and Sezzle, 62% of consumers who attempted transactions with insufficient funds incurred some type of overdraft fees. Specifically, 45% of these consumers were charged a fixed fee, while 27% were charged a percentage of the transaction amount. Additionally, some consumers had to bear a combination of both a flat fee and a percentage-based charge.

Across demographic groups, millennials and bridge millennials were found to have attempted more transactions without sufficient funds than any other age cohort in the past year, at 37% and 34% respectively.

Generation Z — the demographic cohort after the millennials — comes up next, with about 16% of them making transaction attempts without sufficient funds in the past 12 months. Boomers, on the other hand, were the least to have made such attempts in the past year, at only 7%.

In terms of income brackets, high-income consumers — those earning more than $100,000 annually — were the most to have attempted more transactions without sufficient funds in the past year (nearly 25%), compared to those earning less than $50,000.

Drilling down into income brackets shows that the average consumer’s overdraft lasted 9.6 days, and the average amount needed to fully cover the transaction was $369.

Additionally, 4 in 5 consumers who had an overdraft last more than two weeks experienced credit accessibility issues, with 45% unable to pay off credit products or loans.

The study’s findings also showed that consumers who attempted transactions without sufficient funds more frequently experienced financial hardships. And those with more than one overdraft each month reported some form of hardship as a result, compared to those who only overdraft once or twice a year.