Nearly Half of Credit Users Expect Higher Interest Rates in 2024

It seems United States consumers expect little reprieve from inflation-fueled rising prices of goods and services moving into 2024. Although consumers report feeling somewhat better about their current finances, data shows that optimism for 2024 remains lukewarm.

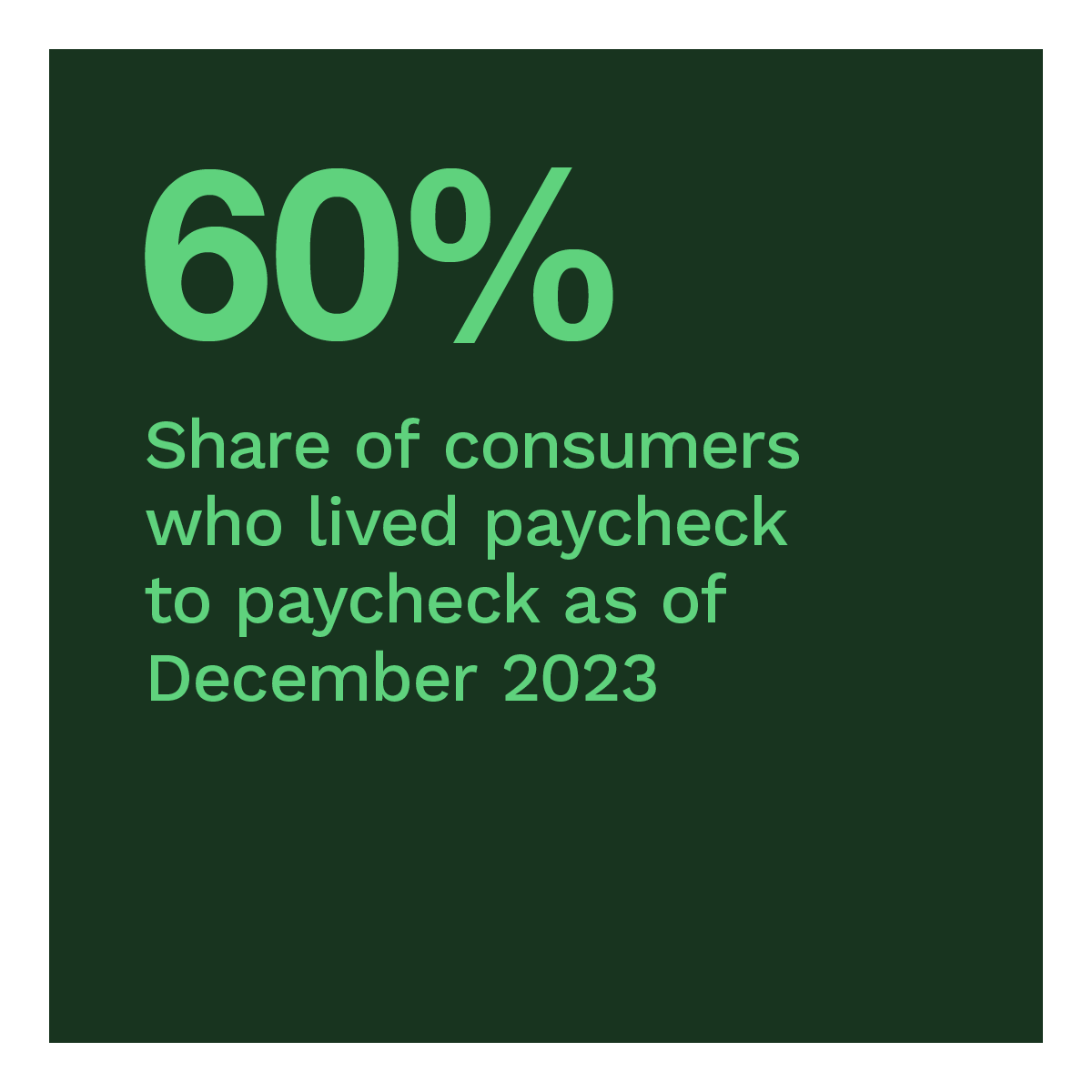

As of December 2023, 60% of consumers lived paycheck to paycheck, with 19% struggling to pay their monthly bills. These shares have dropped compared to December 2022, suggesting that the average consumer could cope with the additional stress of holiday spending without a sizeable impact on their financial standing — as it did when inflation was higher this time last year.

These are some of the findings detailed in this edition of “New Reality Check: The Paycheck-to-Paycheck Report,” a PYMNTS Intelligence report. The Pessimism About Pay Rises Offsets the Effect of Falling Inflation edition examines U.S. consumers’ financial lifestyles and explores their economic outlook and confidence that wages will keep up with inflation in 2024. This edition draws on insights from a survey of 4,380 U.S. consumers conducted from Dec. 12, 2023, to Dec.18, 2023, and an analysis of other economic data.

Other key findings from the report include:

Workers are lowering expectations for inflation-matching wages in a tougher job market.

Paycheck increases in most sectors have lagged inflation in the past two years. Leisure and hospitality workers were the only segment who saw wages grow on par with inflation. It is little surprise that just 38% of wage earners expect a comparable increase in their earnings in 2024, down from 43% in 2023. Among wage earners living paycheck to paycheck with issues paying bills, 29% expect income increases comparable to inflation this year, while 40% said the same in 2023.

Lower interest rates could be central to consumers’ financial health.

Debt remains a common driver of financial uncertainty, with 23% of U.S. consumers experiencing debt-related financial distress. Just 23% of credit holders expect lower rates in the coming year. In contrast, 42% of credit users expect the interest rates for their loans to increase in 2024. Consumers who live paycheck to paycheck report concerns about interest rates at significantly higher rates.

Debt remains a common driver of financial uncertainty, with 23% of U.S. consumers experiencing debt-related financial distress. Just 23% of credit holders expect lower rates in the coming year. In contrast, 42% of credit users expect the interest rates for their loans to increase in 2024. Consumers who live paycheck to paycheck report concerns about interest rates at significantly higher rates.

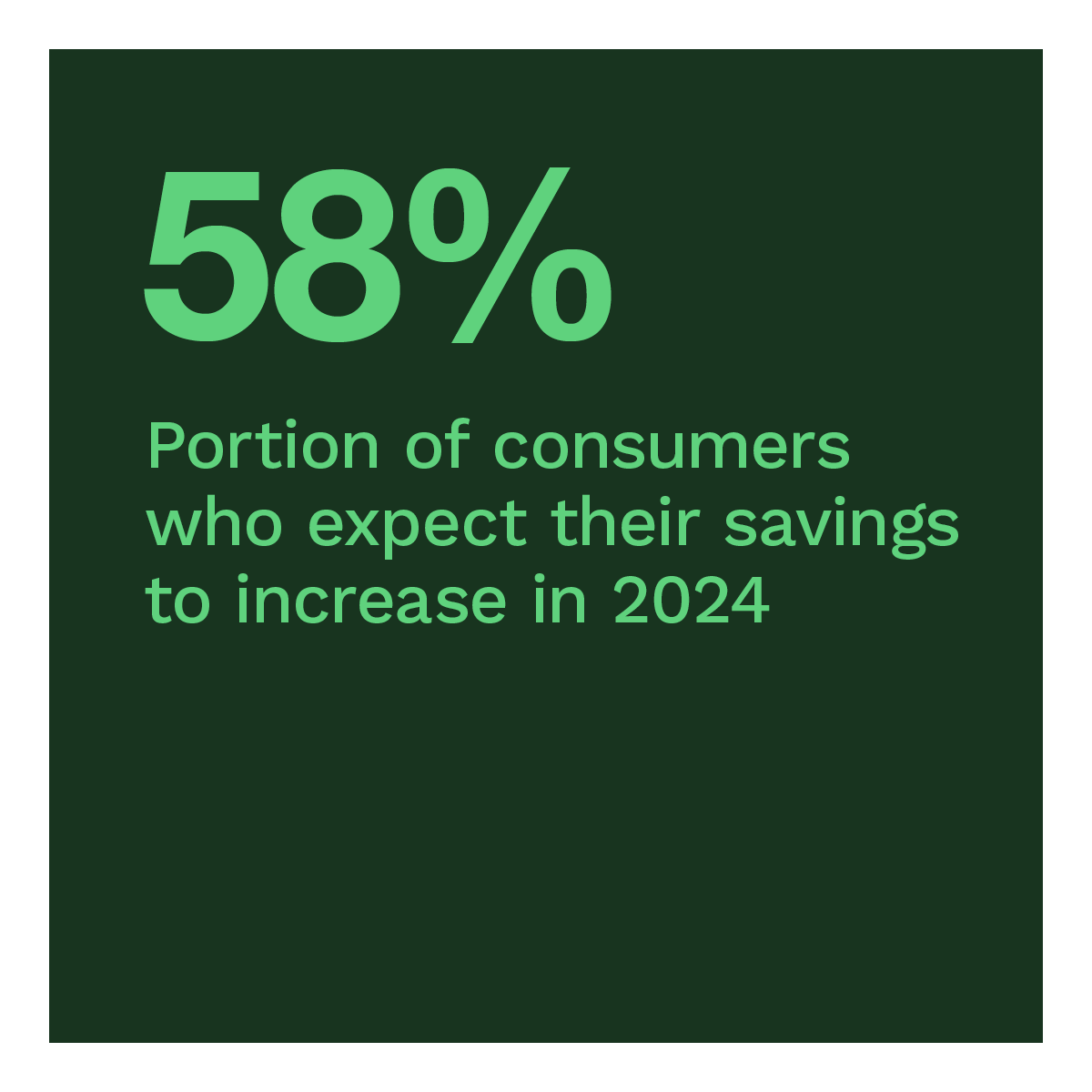

Despite inflation rates, most consumers expect to end 2024 with increased savings.

Even though the inflation rate remains high by historical standards, 59% of consumers expect their savings to increase this year. In 2023, consumers’ average readily available savings balances increased 13% in real terms from December 2022. Consumers who were not living paycheck to paycheck drove this increase. Now, few consumers expect that tapping their savings for discretionary purchases in the next year will lead to a lower savings balance.

Paycheck-to-paycheck consumers do their best to manage spending to live within their means, yet have had to temper their 2024 expectations due to inflationary pressures and stagnate wage growth. Download the report to learn paycheck-to-paycheck consumers’ outlook for 2024.