NEW DATA: Increasing Number of Credit Union Members Drawn to More Innovative Banking Alternatives

Credit unions (CUs) and financial institutions (FIs) are making more of an effort to understand how innovative technologies like cryptocurrency, blockchain and peer-to-peer (P2P) payments will change the way they deliver products and services to members and customers.

CUs in particular are contending with the challenge of continuing to satisfy members with the traditional services they have used for decades and delivering the latest offerings that many members want. PYMNTS data has found that half of CU members value product innovation, and nearly one-quarter say they would take their business to another FI for more innovative products and services. The CUs that work overtime to understand the types of innovation that best satisfy member demand can reduce the likelihood of losing their members to other FIs or FinTechs.

These are just a few findings in “Credit Union Innovation: The Race To Meet Consumer Demand,” a PYMNTS and PSCU collaboration. We surveyed 6,483 United States FI account holders, including 2,073 CU members and 4,410 customers of other FIs, from April 1 to April 21 about how they valued innovative products and services from their financial services providers. PYMNTS also interviewed 101 credit union executives from April 4 to April 20 about their responsibilities for a range of functions, including operations, product development and research and development.  Finally, we interviewed 50 executives from FinTechs that provide products and services to consumers, credit unions, commercial banks and community banks from April 6 to April 20.

Finally, we interviewed 50 executives from FinTechs that provide products and services to consumers, credit unions, commercial banks and community banks from April 6 to April 20.

Some additional key findings include the following:

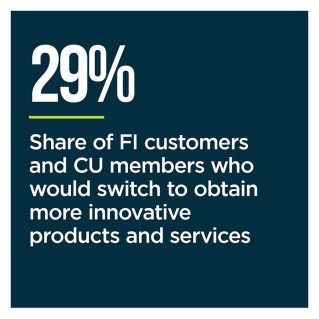

• Twenty-nine percent of FI account holders and CU members, a record high, say they would switch providers to obtain more innovative service offerings. The previous high-water mark for account holders willing to switch for innovation was 26% in 2019 and 2020. The willingness to switch is less pronounced among CU members, however: just 24% would consider switching to receive innovative products, while 31% of other FIs’ customers would do the same.

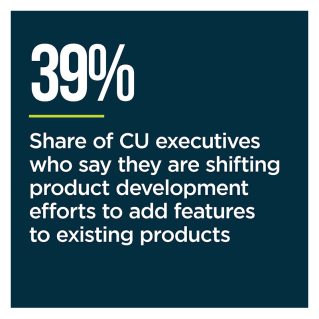

• Thirty-nine percent of CU executives are shifting product development efforts to focus on the addition of new features to existing products. Meanwhile, the share of CUs that stress the development of new, innovative products dropped to 18% in 2022 from 21% in 2021 — a further reflection of the challenges all FIs face as they try to beat their competitors in bringing new, innovative products to market.

• Sixty percent of CUs say they are investing in innovative products such as real-time and P2P payments, an increase from the 50% of CUs that made these investments in 2021. When it comes to mobile banking, however, the proportion of CUs making investments has decreased to 60% from 74% a year ago.

• Sixty percent of CUs say they are investing in innovative products such as real-time and P2P payments, an increase from the 50% of CUs that made these investments in 2021. When it comes to mobile banking, however, the proportion of CUs making investments has decreased to 60% from 74% a year ago.

As the digital shift continues and gains momentum, more consumers will inevitably demand that their trusted financial services providers deliver more advanced products and services. Much of this interest stems from consumers’ desire for greater convenience and saved time. The 20% of FI account holders who use only digital banking channels are proof of this. As CUs increase their investments in innovative products and enhance existing offerings, they will appeal to the members who want access to digital payments, lower their exposure to the risk of member churn and best position themselves to maintain relationships with account holders.

To learn more about the strategies credit unions can adopt to provide members with the products and services that appeal to them, download the report.