One-Third of Credit Union Members Would Leave for Better Credit Products

Consumers in the United States rely less on their primary financial institution (FI) for major credit products than they used to. Many are shopping around for better deals on rates and terms and for a larger variety of products, resulting in increased competition from non-bank and non-credit union financial entities such as FinTechs.

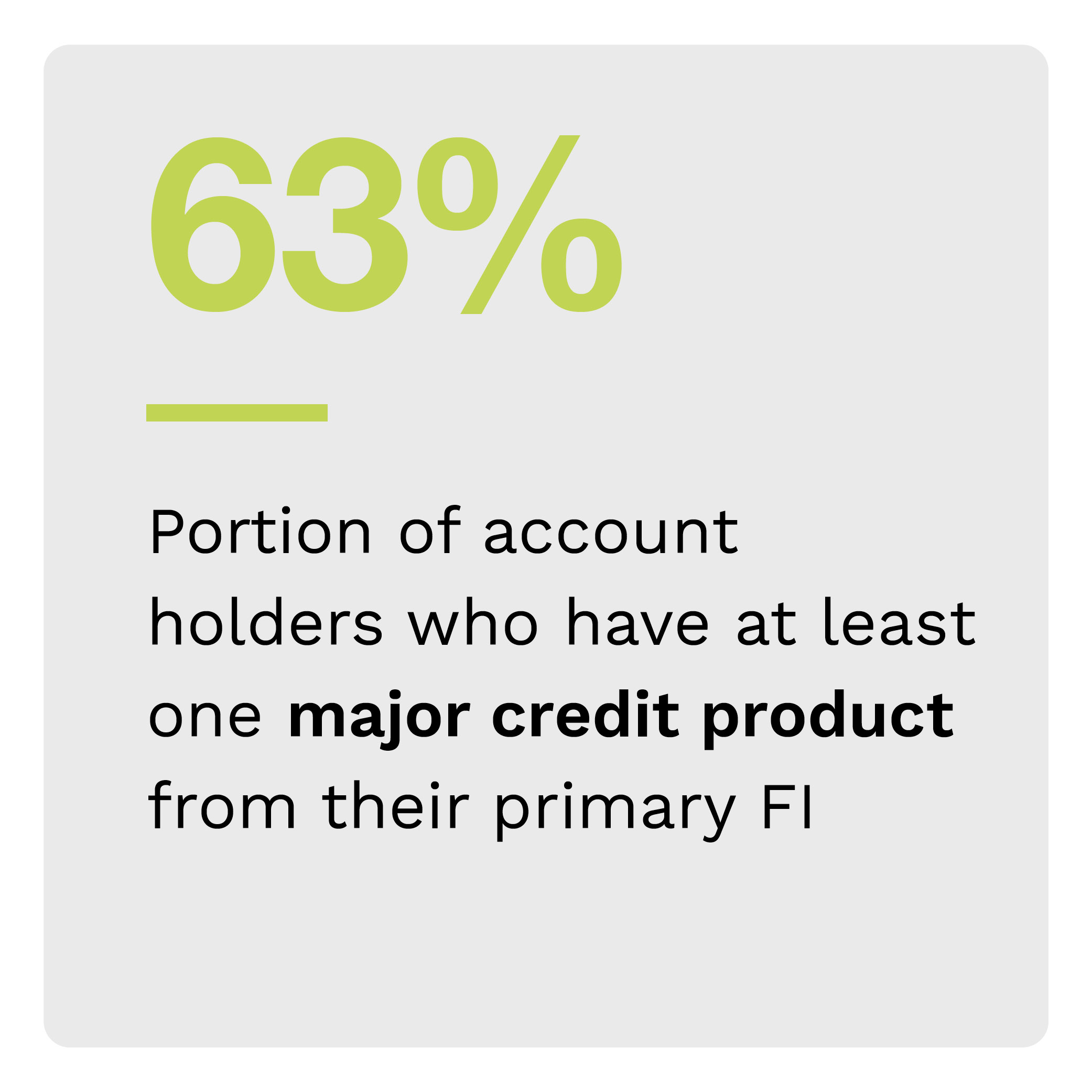

Although 63% of account holders have at least one of four major credit products with their primary FI, our research found that other banks or CUs provide 48% of mortgages and 41% of auto loans to the same audience. This shows that customers are willing to look elsewhere for better terms on these loans to help them lower the cost of credit and increase their savings.

Although 63% of account holders have at least one of four major credit products with their primary FI, our research found that other banks or CUs provide 48% of mortgages and 41% of auto loans to the same audience. This shows that customers are willing to look elsewhere for better terms on these loans to help them lower the cost of credit and increase their savings.

This is one of the key findings in “Credit Union Innovation: How Credit Products’ Rates and Terms Impact FI Selection,” a PYMNTS and PSCU collaboration. The report examines consumers’ criteria for choosing credit products, which could determine their choice of FIs. Our findings are based on three surveys with responses from 4,097 consumers, conducted between April 3 and April 24; 100 CU executives who influence financial management, conducted between April 3 and April 27; and 54 FinTech executives who provide services to most FIs, conducted between April 3 and April 26.

More key findings include the following:

Attractive rates and terms are the most critical factor for account holders when deciding where to apply for credit products — and may impact whether they switch FIs.

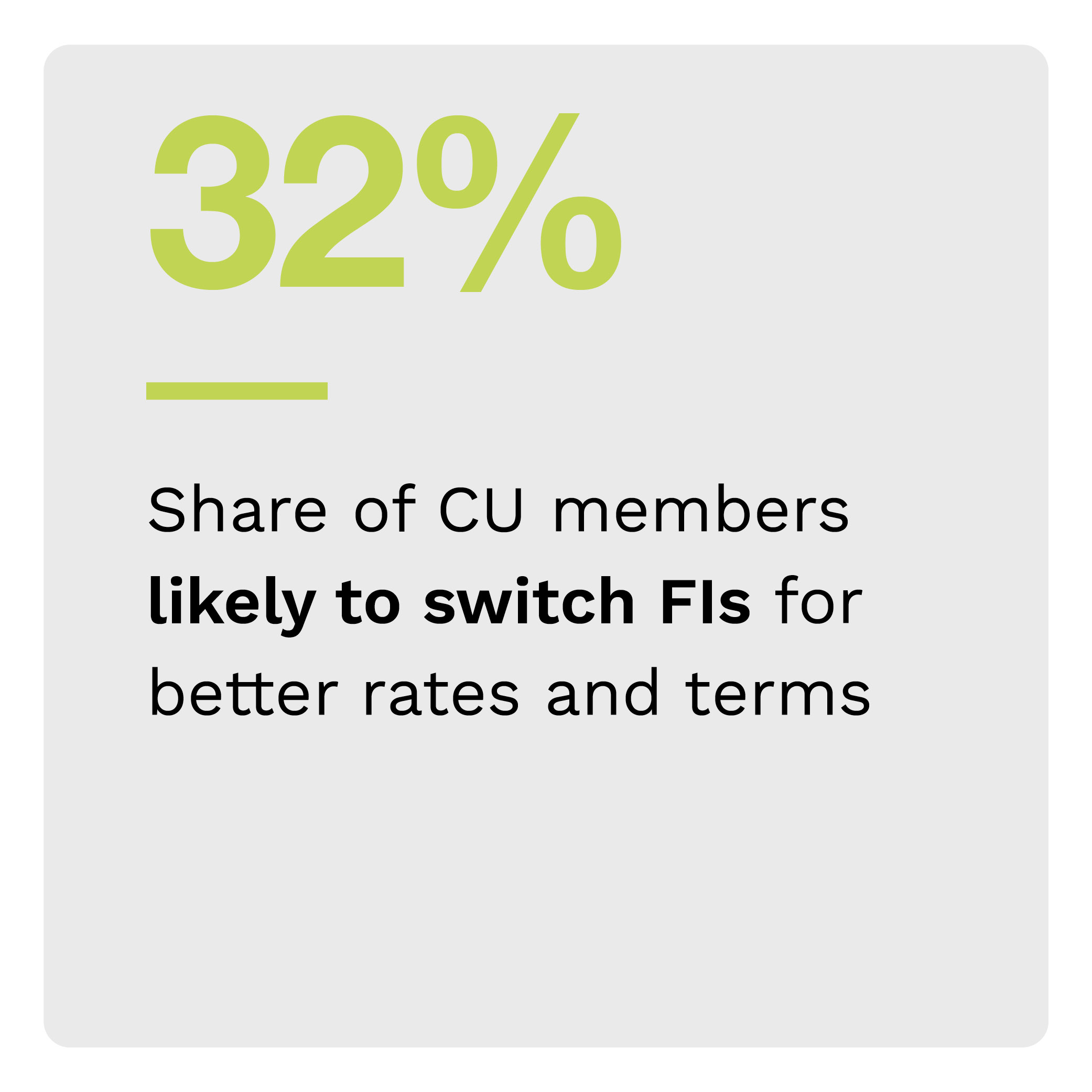

FIs can persuade consumers to move accounts away from their primary FIs by offering credit products with favorable conditions, with 29% of consumers saying that they would be very or extremely likely to do so. PYMNTS’ research found that consumers are more likely to cite interest rates and terms as most influential to their decision of where to apply for credit than any other factor.

While most FIs face comparable constraints on interest rates, they can compete for business by offering different services and terms, including lower fees and commissions, longer loan terms, larger credit limits and faster credit approval.

Reducing the time to access funds from credit products is becoming a key factor in attracting and retaining account holders.

CUs are working to shorten the time it takes for members to access funds from credit products, perhaps assuming it will draw and retain members. Forty-five percent of CUs say they have made very or extremely significant efforts to cut down credit product setup times.

But CU executives may be overvaluing the importance of fast funding. While 59% of CUs believe product setup times are highly influential in consumers’ decisions to apply for credit products, just 5.8% of account holders see this as the most influential factor in deciding to apply.

Most CUs have no immediate plans to offer installment payment plans such as BNPL, which FinTechs are already capitalizing on.

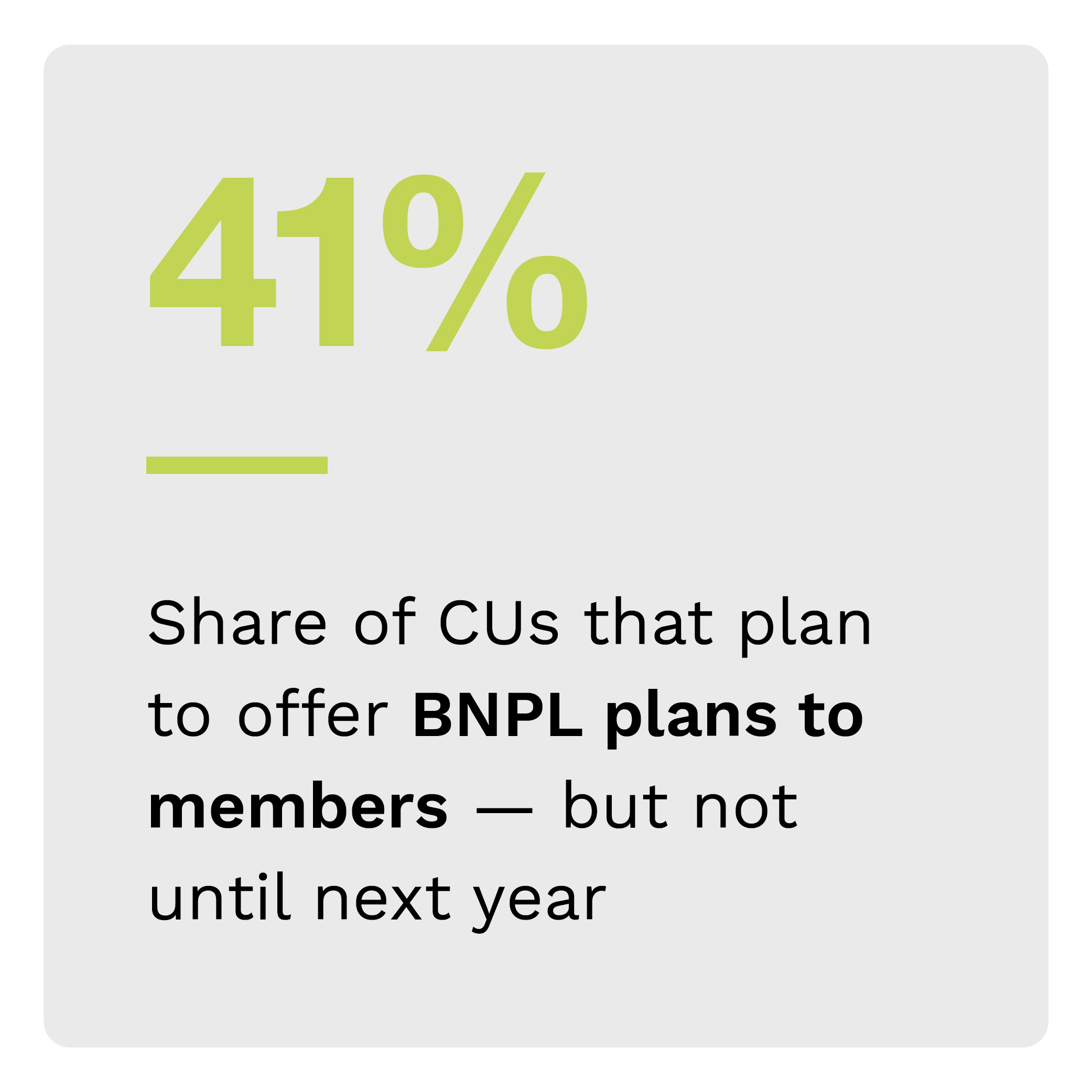

Amid high inflation and the possibility of tougher economic conditions to come, CUs’ reluctance to offer products in demand among demographic groups in their prime earning years may impact their ability to attract or retain members. Our survey found that 39% of CUs do not plan to offer installment payment options such as BNPL to members. Even the 41% that plan to do so will not roll out the product in the next year.

Amid high inflation and the possibility of tougher economic conditions to come, CUs’ reluctance to offer products in demand among demographic groups in their prime earning years may impact their ability to attract or retain members. Our survey found that 39% of CUs do not plan to offer installment payment options such as BNPL to members. Even the 41% that plan to do so will not roll out the product in the next year.

This is an area where non-CU FIs and FinTechs, which are beginning to market directly to consumers, may develop a competitive edge over CUs. Installment payment plans and personal loans are the most common products FinTechs offer customers, at 30% and 28%, respectively. More than one-third of FinTechs are at least somewhat interested in offering several additional products directly to consumers.

CUs have taken a wait-and-see approach to credit innovation, and this approach may increasingly become a detriment. Download the report to learn more about how interest rates and terms of credit products affect consumers’ choice of FI.