New Data Shows Nearly 80% of Crypto Consumers Use Bitcoin to Pay Online and In-Store

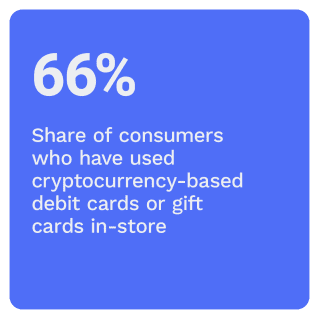

The Biden administration’s March 2022 executive order and recognition of digital currencies on a national scale comes when the U.S. consumer ownership and usage of cryptocurrencies as a viable payment method is reaching unprecedented heights. Not only do 16% of U.S. consumers — 41.2 million people — now own at least one type of cryptocurrency, but 16.1 million have used cryptocurrencies to make online purchases in the last 30 days, and 7.1 million have used it to make in-store purchases in that time.

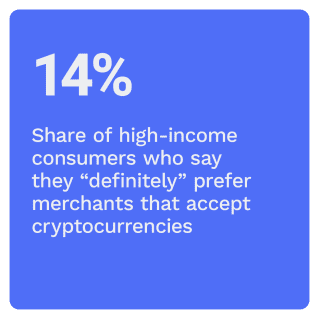

Most consumers still see crypto chiefly as a type of investment rather than a payment method — but that is rapidly changing among a growing cohort of crypto owners. PYMNTS research shows that while roughly half of the consumers who own cryptocurrency use it as an investment, nearly one-third of consumers who hold or have held cryptocurrency in the last 12 months say they would switch merchants if it meant they could pay with cryptocurrency. Primarily high-income millennials use cryptocurrency to buy everything from groceries and clothes to gaming and entertainment subscriptions.

These are just some of the findings in “The U.S. Crypto Consumer: Cryptocurrency Use In Online And In-Store Purchases,” a PYMNTS and BitPay collaboration. In this report, we surveyed 2,334 current or former cryptocurrency users and nonusers in the U.S. to learn more about consumers’ growing interest in cryptocurrency and plans for ownership and use of cryptocurrency.

More key findings from the study include:

• Twenty-three percent of consumers — 59.6 million people — have owned at least one cryptocurrency in the past year, up from 16% — 41.5 million people — in 2021. Sixteen percent currently own cryptocurrencies, with 7% saying they owned them in the past but do not now. The share of consumers owning cryptocurrencies in 2022 has increased four percentage points from 2021. Last year, just 12% of survey respondents reported that they currently held cryptocurrencies. Cryptocurrency owners are most likely to be millennials and high-income consumers.

• Bitcoin enjoys a comfortable lead above all other cryptocurrencies regarding consumer usage and awareness. Bitcoin is a clear market leader in recognition and user penetration. PYMNTS’ research finds that among 12 players in the cryptocurrency market currently held by survey respondents, 12% of consumers hold Bitcoin, 5% have held it in the last 12 months and 2% have held it at some point in time. Also, 74% of consumers who have never held Bitcoin have heard of it, and just 8% said they have not heard of Bitcoin. Ethereum and Dogecoin are also among the top cryptocurrencies currently held by consumers.

• High-income consumers and millennials are most likely to view cryptocurrency as a payment option. When asked if cryptocurrencies are a viable payment alternative, there was an even split among consumers as to whether they held a neutral or negative view of the technology. Thirty-six percent of consumers had neutral or negative perceptions of cryptocurrencies as a payment alternative. Just 28% expressed a positive view, but this share increases among millennials and consumers earning more than $100,000. Forty-eight percent of millennials and 32% of high-income consumers positively viewed cryptocurrency as a viable payment method.

To learn more about U.S. consumers’ growing interest in ownership and use of cryptocurrency, download the report.