Retail Earnings Reports Signal Shopper Hesitancy Going Into Holiday Shopping Season

Merchants focused on nonessentials are restrategizing as shoppers predict a long way until inflation’s end.

Recent earnings released by retailers may reflect consumers’ true attitudes toward the near-future economic landscape, with well-known merchants struggling to attract much needed sales and bolster their base. This week, (Aug. 22) Macy’s reported its second-quarter earnings, with the famed retailer seeing an 8% decrease in net sales during the quarter, with brick-and-mortar and digital sales both dropping 8% and 10%, respectively, year over year. Noting that consumers are expected to continue a more discriminating mindset when it comes to shopping through the remainder of 2023, Macy’s is streamlining its online platform and physical stores, in some cases reducing its brick-and-mortar footprint.

Target, another discretionary retail mainstay, also reported disappointing earnings for the most recent quarter earlier this month (Aug. 16), meeting analysts’ downgraded expectations. The company saw its second quarter comparable sales decline 5.4%, led by discretionary categories and partially made up for in essentials and beauty as well as food and beverage purchases. Although the earnings of other retailers could conclude a different current consumer spending perspective, Macy’s and Target earnings stand out due to both retailers’ heavy lean on discretionary inventory. Conversely, Walmart’s heavy reliance on the very essential groceries may not be an accurate read on consumer spending sentiment.

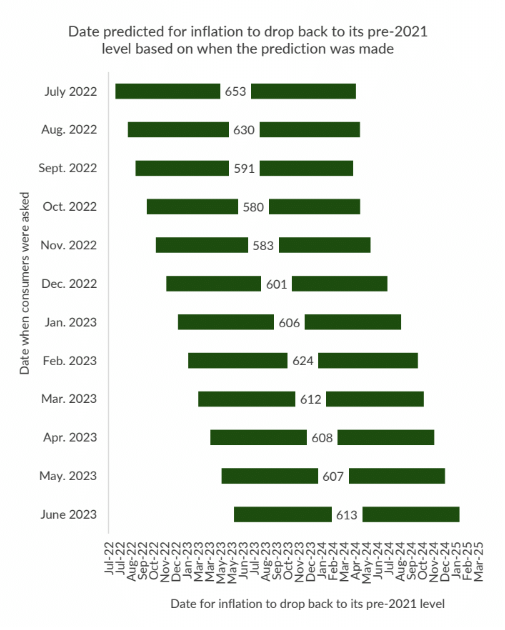

While overall consumer spending on the rise, albeit unevenly, is undoubtedly good news, these discretionary retailer earnings releases may more accurately reflect that consumers’ attitude towards spending is more subdued. A continued sentiment toward pulling back is similarly seen in the accompanying proprietary chart created for PYMNTS’ July “Consumer Inflation Sentiment” report. It reveals consumers’ predicted date for inflation to end, approximately in March 2025 — much in line with the Federal Reserve’s estimation.

There are other hints, as well, that any cause for celebration over a rise in consumer spending may be premature. Namely, while spending may be up, debt held by U.S. households is up as well. Recent Federal Reserve data on big bank loan performance found household debt reaching $17 trillion in Q2 2023, with estimated credit card debt in recent months surpassing $1 trillion. This marks cumulative U.S. household debt rising $2 trillion since shortly before the pandemic, in line with bank earning releases as well noting recently rising delinquency and charge-off rates. During the second quarter of this year, the big banks wrote off a combined $5 billion in defaulted loans. Charge-offs have more finality than accounts considered delinquent, as the lender marks these loans as uncollectable and taken at a loss, resulting in a black mark on the borrower’s credit scores. While it’s nice that consumers are increasing their spend, it seems like a large chunk is being put on plastic — which of course carries an eventual limit. The combined rise in spend, and delinquencies overall, butting up against these limits could mean that the party may already be winding down.

While spending may continue to rise in the coming months as inflation is expected to ebb, consumer sentiment — and select earnings reports — could tell a different story. Until the economy is on clearly firm footing, this consumer hesitancy in spend is expected to remain, and could continue sending discretionary retailers scrambling.