Millennials Focus on Mental Health as Student Loan Repayments Loom

As the October resumption of federal student loan repayments approaches, the financial strain of repaying these loans is expected to have a significant impact on millennials’ overall well-being, particularly on their mental health.

In the July “Consumer Inflation Sentiment Report: Back to School Means Back to Federal Loan Repayments” report, PYMNTS Intelligence draws on insights from a survey of more than 2,200 U.S. consumers to examine and analyze consumer sentiments on federal student loan repayment and inflation, and the impact it will have on their lives.

According to PYMNTS Intelligence, young borrowers worry less about inflation and more about paying back student loans. This is not surprising, as many individuals in this age group are still attending college or have recently graduated, placing them in the midst of their loan repayment years.

In fact, approximately 1 in 4 Generation Z, millennial, and bridge millennial consumers are more concerned about student loans than inflation, the study shows, indicating the significant weight these loans carry in their day-to-day lives.

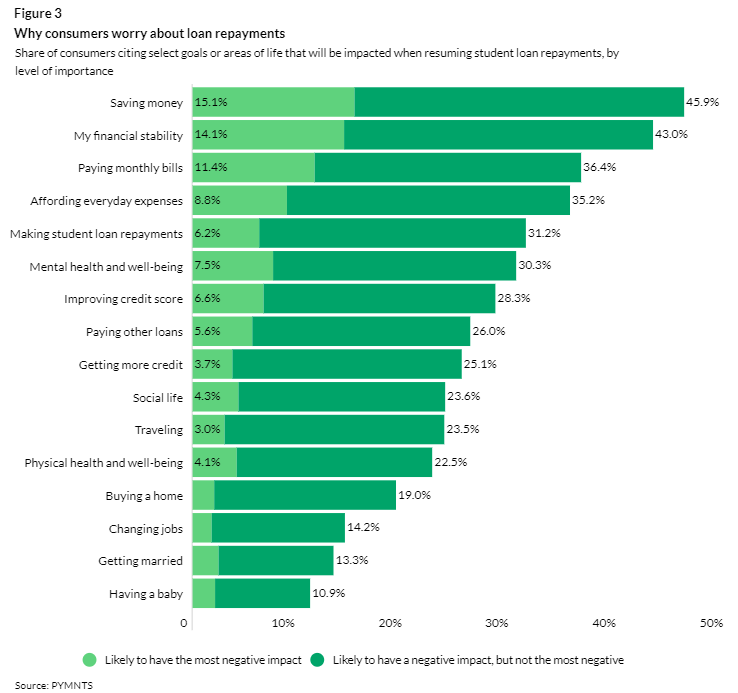

PYMNTS Intelligence found that 43% of consumers with loans who are concerned about repayments believe their financial stability will suffer, while 36% worry about paying monthly bills, and 35% are concerned about affording everyday expenses.

Resuming student loan repayments also means delaying other dreams and goals, with many individuals saying aspirations such as buying a home, getting married and having a baby will have to be put on hold as a result.

Additionally, Gen X, often referred to as “The Forgotten Generation,” face unique financial struggles due to their double financial duties as caretakers for both their children and aging parents or relatives. This sandwiched position, combined with significant student loan debt, has put this age cohort in a precarious financial situation.

Against this backdrop, it comes as little surprise that nearly one in three borrowers say resuming student loan repayments will impact their mental health and well-being.

A Commitment to Personal Wellness

As the time for loan repayments looms, teletherapy platforms can offer relief to millennials and bridge millennials, who are known to prioritize their mental health and seek professional help despite managing tight budgets.

This trend is highlighted in PYMNTS’ May “ConnectedEconomy™ Monthly Report,” which reveals a growing use of teletherapy platforms among millennials and bridge millennials, despite a decrease in usage among other demographics.

The research shows that millennial use of telehealth platforms increased by 8% year-over-year, while bridge millennial use rose by 15% during the same period. These age cohorts already had high levels of participation, with 58% of millennials and 56% of bridge millennials engaging with telehealth platforms on average.

Moreover, the fact that millennials are prioritizing their mental health over short-term satisfactions, such as eating out or indulging in non-essential purchases, suggests a strong commitment to personal wellness.

It is even more significant that young consumers are finding room in their budgets for therapy sessions, especially when data shows that they will be losing an average of 6.5% of their spending power as loan repayments resume.

Finally, with the burden of student loan repayments weighing heavily on millennials and bridge millennial borrowers, taking proactive steps towards maintaining their mental health well-being can go a long way to ensure that they are fully equipped to navigate the financial challenges that lie ahead.