Restaurants’ Apps and Sites Take a Bite Out of Aggregators

In the last decade — particularly during the pandemic’s peak — third-party food aggregators have dominated digital ordering and fulfillment in the restaurant space. The tide has begun to change, however. PYMNTS’ latest consumer research finds that just 8% of consumers used aggregators for at least half of their restaurant purchases in September. Displacing these platforms are the apps and websites offered by restaurants.

These are some of the key findings from this edition of “The 2022 Restaurant Digital Divide: Restaurant Apps And Websites In The Spotlight.” For this report, PYMNTS surveyed a census-balanced panel of 1,996 United States consumers to reveal the current state of play for digital meal ordering. The report takes a deep dive into trending consumer behaviors and preferences when using first-party and third-party channels and how they are changing as restaurants increasingly leverage more advanced digital solutions to help beat aggregators at their own game.

• Consumers are more frequently ordering meals through a restaurant’s app or website than through aggregators.

Twice as many diners use a restaurant’s digital channels to place at least half their orders than they do through aggregators. Sixteen percent of diners use these first-party channels to order at least half of their restaurant meals directly from the restaurants, and another 14% do so for between one-quarter and one-half of their purchases.

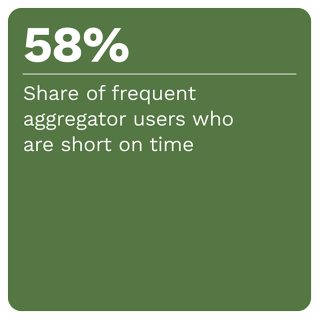

PYMNTS data reveals that 58% of diners likely to order from aggregators say they are short on time when ordering from restaurants, and 49% of their counterparts using first-party apps and websites say the same. Just 19% of customers who frequently dine in at restaurants say they are in a hurry when purchasing those meals.

• Access to restaurants’ loyalty programs through their first-party apps and websites increases consumers’ appetites for ordering and engaging through these channels.

Forty-five percent of frequent first-party app and website users cite better access to discounts or rewards as an influential feature impacting their preferences for these first-party channels, as do 37% of aggregator users. Frequent on-premises diners buck this trend, however, with just 10% stating that access to loyalty benefits impacts their purchasing behavior.

To learn more about recent developments in digital meal ordering, download the report.